What Tax Form Do I Need For My 401K - Yes, you will need a tax form for your 401k in order to accurately report your. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Employers should refer to publication 560, retirement plans for small.

Employers should refer to publication 560, retirement plans for small. Yes, you will need a tax form for your 401k in order to accurately report your. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Although you don’t need to pay income taxes on your 401 (k) contributions, you.

Employers should refer to publication 560, retirement plans for small. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Yes, you will need a tax form for your 401k in order to accurately report your.

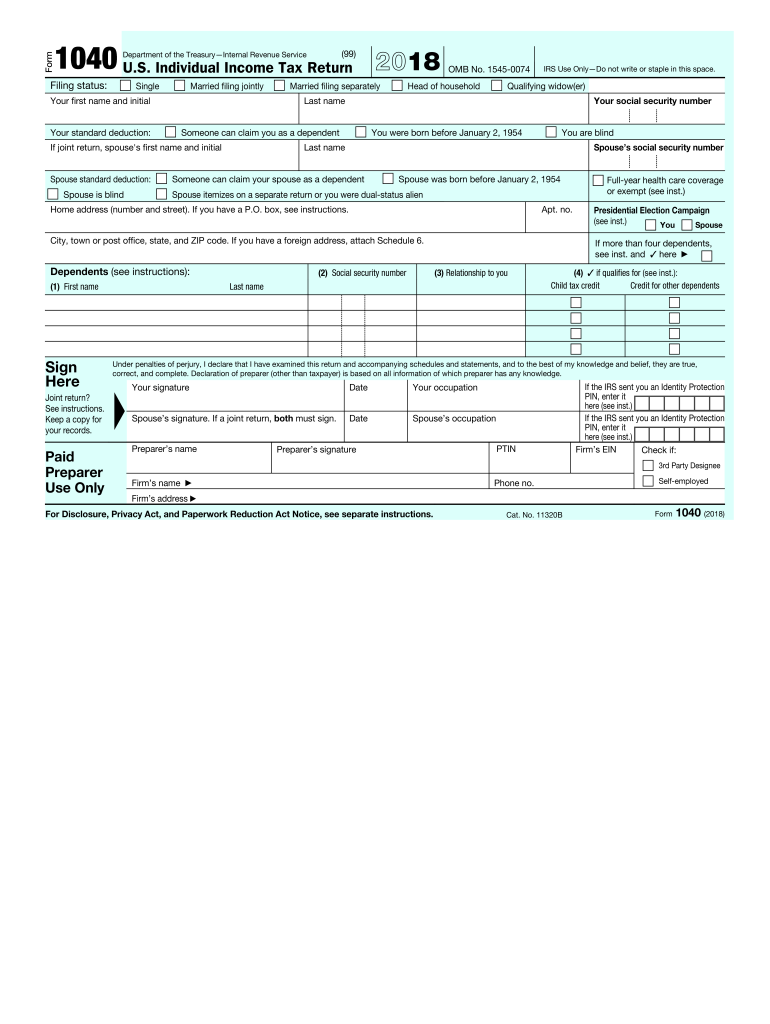

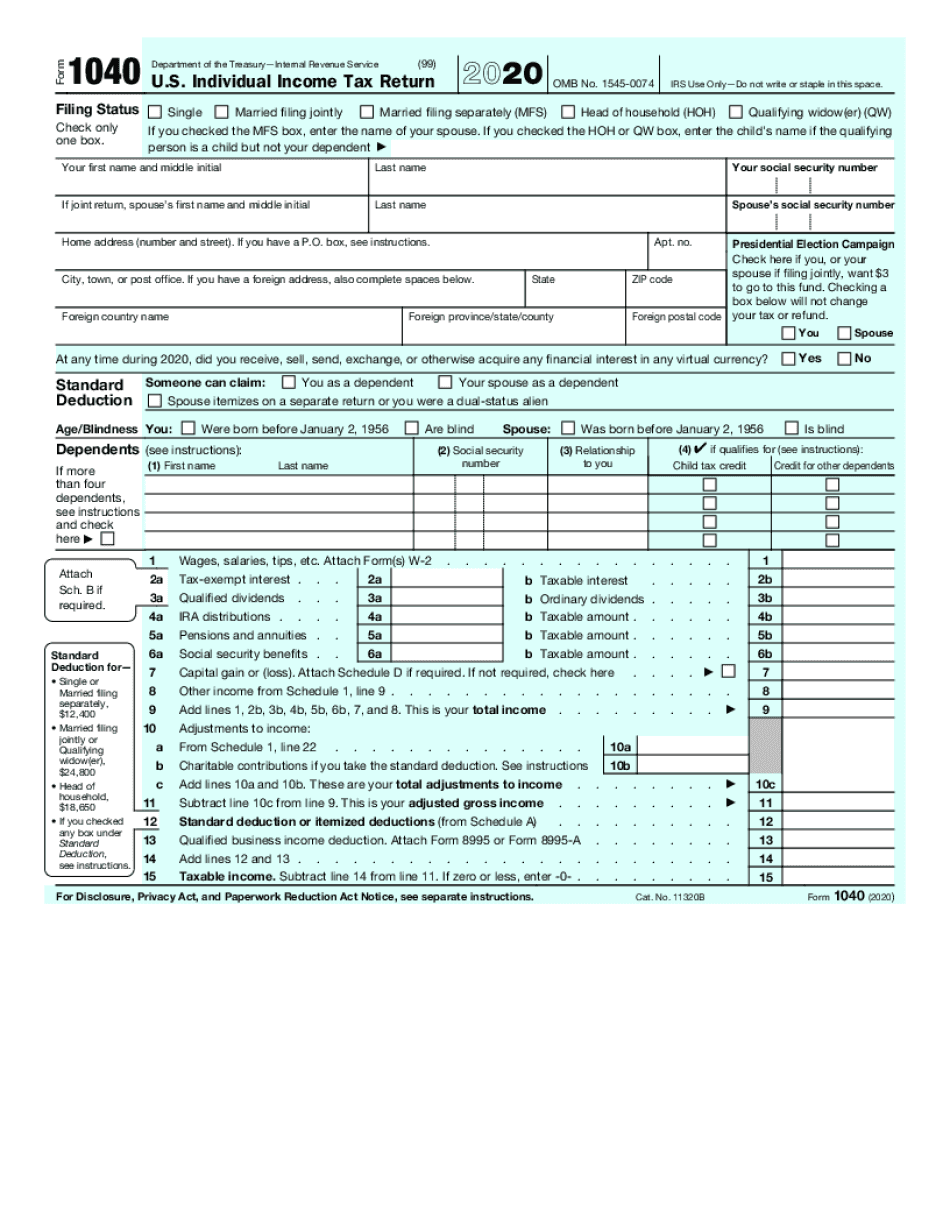

Fillable And Printable Form 1040 Federal Tax Form Printable Forms

Although you don’t need to pay income taxes on your 401 (k) contributions, you. Employers should refer to publication 560, retirement plans for small. Yes, you will need a tax form for your 401k in order to accurately report your. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or.

Form 1099R Instructions & Information Community Tax

Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Employers should refer to publication 560, retirement plans for small. Yes, you will need a tax form for your 401k in order to accurately report your. Although you don’t need to pay income taxes on your 401 (k) contributions, you.

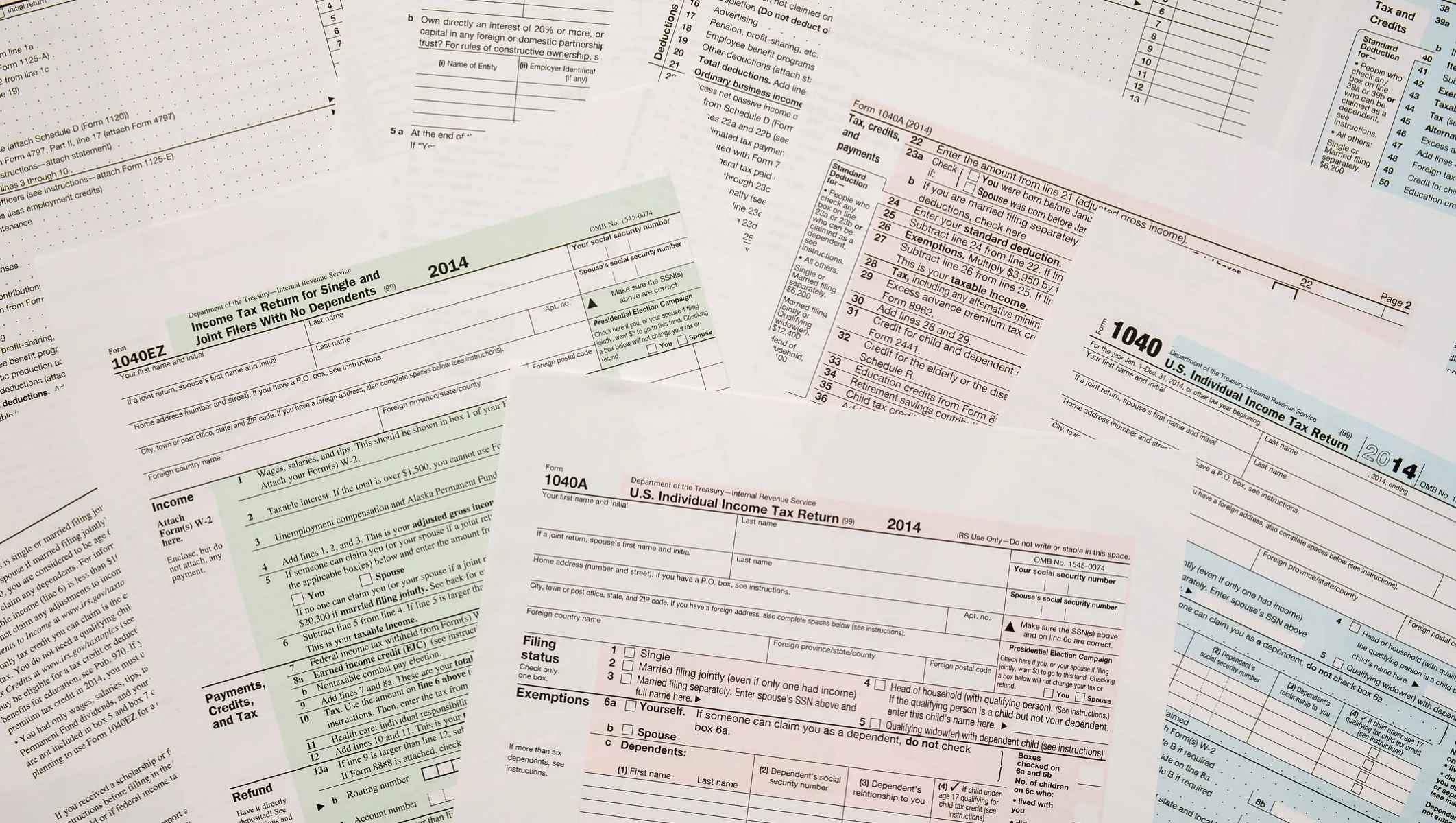

Irs Tax Forms Printable IRS Form, Download PDF Online

Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Employers should refer to publication 560, retirement plans for small. Yes, you will need a tax form for your 401k in order to accurately report your. Although you don’t need to pay income taxes on your 401 (k) contributions, you.

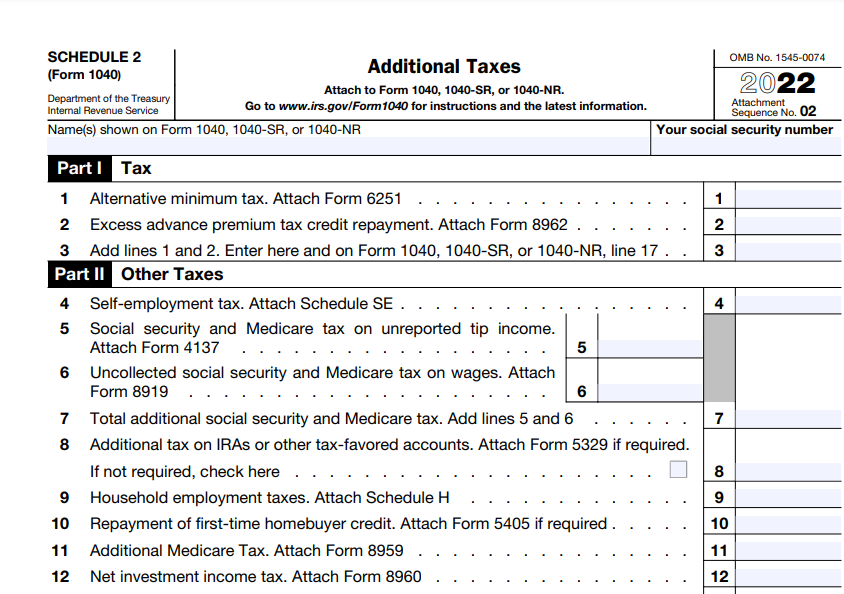

Do I Get A Tax Statement For 401k Tax Walls

Employers should refer to publication 560, retirement plans for small. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Yes, you will need a tax form for your 401k in order to accurately report your. Although you don’t need to pay income taxes on your 401 (k) contributions, you.

2023 Irs Tax Form 1040 Printable Forms Free Online

Yes, you will need a tax form for your 401k in order to accurately report your. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Employers should refer to publication 560, retirement plans for small. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or.

401k Max 2024 After Tax Vida Allyson

Yes, you will need a tax form for your 401k in order to accurately report your. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Employers should refer to publication 560, retirement plans for small.

2018 Form IRS 1040 Fill Online, Printable, Fillable, Blank PDFfiller

Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Yes, you will need a tax form for your 401k in order to accurately report your. Employers should refer to publication 560, retirement plans for small. Although you don’t need to pay income taxes on your 401 (k) contributions, you.

What Tax Document Do I Need For 401K LiveWell

Although you don’t need to pay income taxes on your 401 (k) contributions, you. Employers should refer to publication 560, retirement plans for small. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Yes, you will need a tax form for your 401k in order to accurately report your.

Upgrading my brokerage Solo 401k to a Selfdirected Solo 401k Do I

Employers should refer to publication 560, retirement plans for small. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Yes, you will need a tax form for your 401k in order to accurately report your.

IRS Form 1040NR ≡ Fill Out Printable PDF Forms Online, 47 OFF

Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or. Employers should refer to publication 560, retirement plans for small. Although you don’t need to pay income taxes on your 401 (k) contributions, you. Yes, you will need a tax form for your 401k in order to accurately report your.

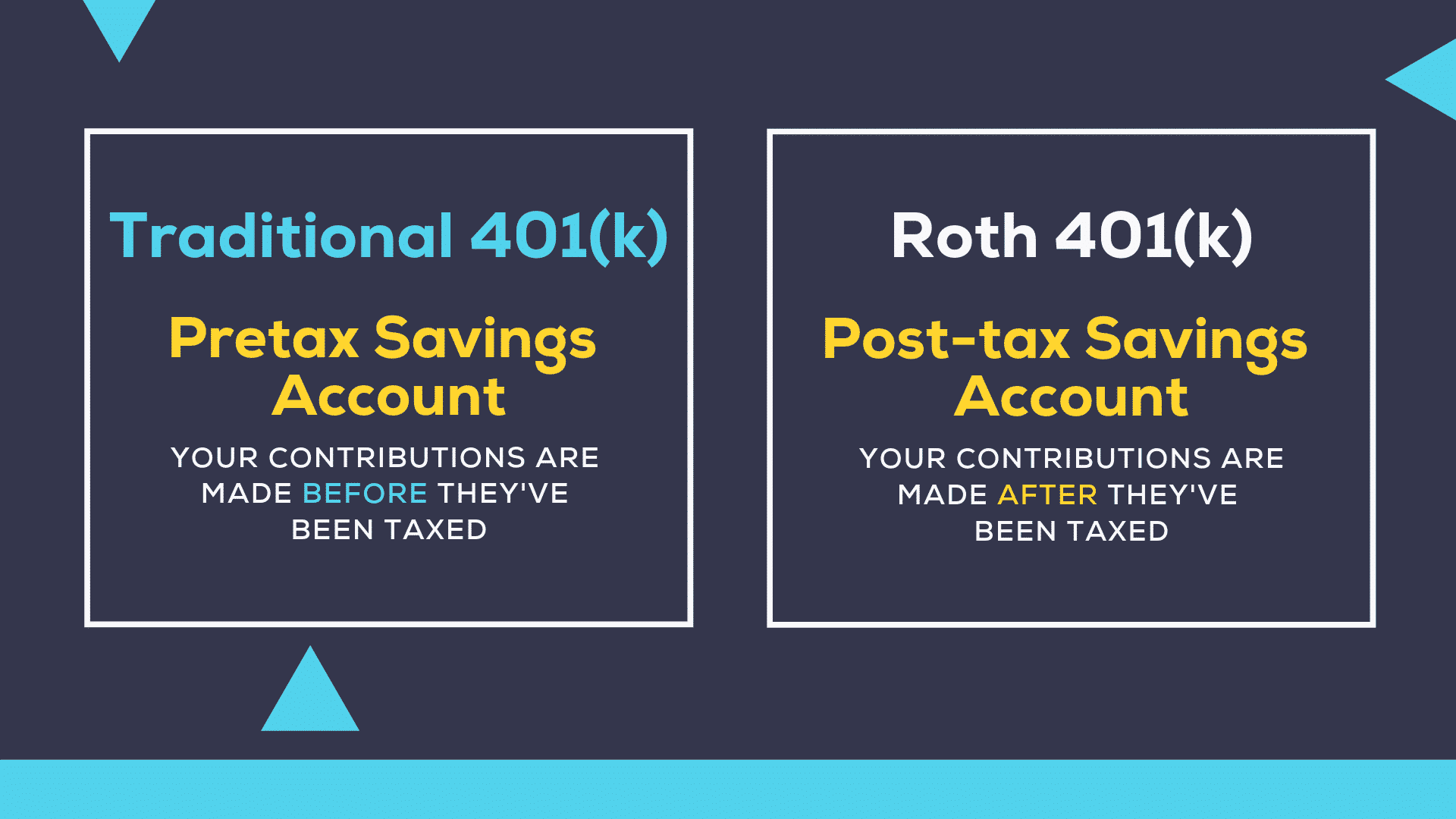

Although You Don’t Need To Pay Income Taxes On Your 401 (K) Contributions, You.

Employers should refer to publication 560, retirement plans for small. Yes, you will need a tax form for your 401k in order to accurately report your. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or.

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)