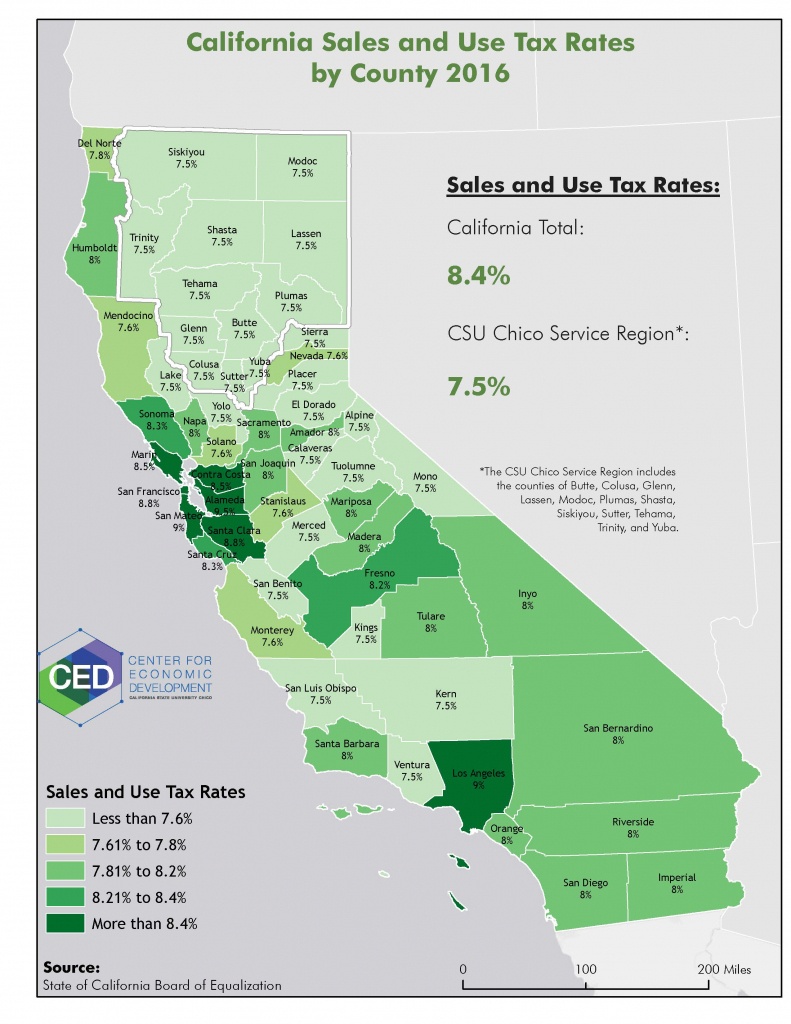

What Is The Sales Tax In Fresno California - The current total local sales tax rate in fresno, ca is 8.350%. The current sales tax rate in fresno, ca is 7.98%. The state of california has a general sales tax rate of 6% which applies statewide. 547 rows for a list of your current and historical rates, go to the california city & county sales &. This is the total of. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local. Click for sales tax rates, fresno sales tax. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. The minimum combined 2025 sales tax rate for fresno, california is 7.98%.

The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The state of california has a general sales tax rate of 6% which applies statewide. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local. 547 rows for a list of your current and historical rates, go to the california city & county sales &. This is the total of. The current sales tax rate in fresno, ca is 7.98%. The current total local sales tax rate in fresno, ca is 8.350%. Click for sales tax rates, fresno sales tax.

The current sales tax rate in fresno, ca is 7.98%. The state of california has a general sales tax rate of 6% which applies statewide. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local. The minimum combined 2025 sales tax rate for fresno, california is 7.98%. 547 rows for a list of your current and historical rates, go to the california city & county sales &. The current total local sales tax rate in fresno, ca is 8.350%. Click for sales tax rates, fresno sales tax. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. This is the total of.

Fresno, California Sales Tax Calculator 2024 Investomatica

The state of california has a general sales tax rate of 6% which applies statewide. The current total local sales tax rate in fresno, ca is 8.350%. The current sales tax rate in fresno, ca is 7.98%. 547 rows for a list of your current and historical rates, go to the california city & county sales &. The minimum combined.

California Sales Tax Calculator 2024

The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. The current sales tax rate in fresno, ca is 7.98%. The state of california has a general sales tax rate of 6% which applies statewide. 547 rows for a list of your current and historical rates, go to the california city & county.

California Sales Tax 2025 Zoe Tucker

The minimum combined 2025 sales tax rate for fresno, california is 7.98%. 547 rows for a list of your current and historical rates, go to the california city & county sales &. Click for sales tax rates, fresno sales tax. The current sales tax rate in fresno, ca is 7.98%. The current total local sales tax rate in fresno, ca.

City of Fresno begins collecting Measure P sales tax ABC30 Fresno

The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. 547 rows for a list of your current and historical rates, go to the california city & county sales &. This is the total of. The current sales tax rate in fresno, ca is 7.98%. Click for sales tax rates, fresno sales tax.

Application for Business Tax Certificate City of Fresno

Click for sales tax rates, fresno sales tax. The current total local sales tax rate in fresno, ca is 8.350%. The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The current sales tax rate in fresno, ca is 7.98%. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local.

Sales Taxstate Here's How Much You're Really Paying California Sales

This is the total of. The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local. The current sales tax rate in fresno, ca is.

Mayor Brand pushing for half cent increase in Fresno's sales tax

1501 rows california has state sales tax of 6%, and allows local governments to collect a local. The current total local sales tax rate in fresno, ca is 8.350%. The current sales tax rate in fresno, ca is 7.98%. This is the total of. The minimum combined 2025 sales tax rate for fresno, california is 7.98%.

California Sales Tax Guide for Businesses

The current total local sales tax rate in fresno, ca is 8.350%. This is the total of. 547 rows for a list of your current and historical rates, go to the california city & county sales &. The state of california has a general sales tax rate of 6% which applies statewide. Click for sales tax rates, fresno sales tax.

California Sales Tax 2025 Zoe Tucker

1501 rows california has state sales tax of 6%, and allows local governments to collect a local. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and. The current sales tax rate in fresno, ca is 7.98%. The state of california has a general sales tax rate of 6% which applies statewide. This.

Ultimate California Sales Tax Guide Zamp

547 rows for a list of your current and historical rates, go to the california city & county sales &. The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The current sales tax rate in fresno, ca is 7.98%. The current total local sales tax rate in fresno, ca is 8.350%. Click for sales tax rates, fresno.

547 Rows For A List Of Your Current And Historical Rates, Go To The California City & County Sales &.

This is the total of. The current sales tax rate in fresno, ca is 7.98%. Click for sales tax rates, fresno sales tax. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and.

The State Of California Has A General Sales Tax Rate Of 6% Which Applies Statewide.

1501 rows california has state sales tax of 6%, and allows local governments to collect a local. The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The current total local sales tax rate in fresno, ca is 8.350%.