What If I Have Two W2 Forms From Different States - No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. You must enter that amount in the federal wages field using the appropriate state.

You must enter that amount in the federal wages field using the appropriate state. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. No, if you worked in two different states the amounts in box 16 should be.

You must enter that amount in the federal wages field using the appropriate state. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. No, if you worked in two different states the amounts in box 16 should be.

Can You File Two W2 Forms? A guide to All Things W2 Canal HR

No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. You must enter that amount in the federal wages field using the appropriate state.

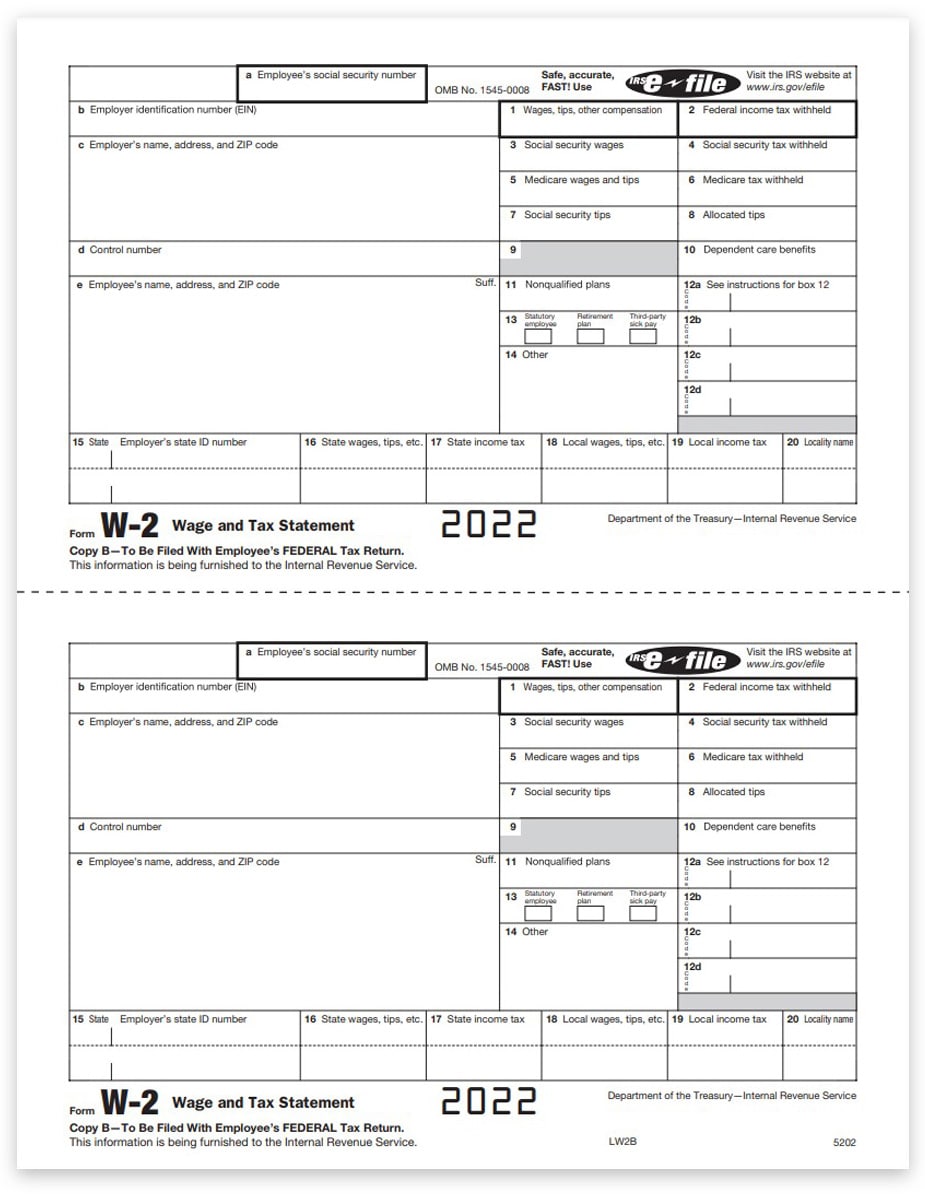

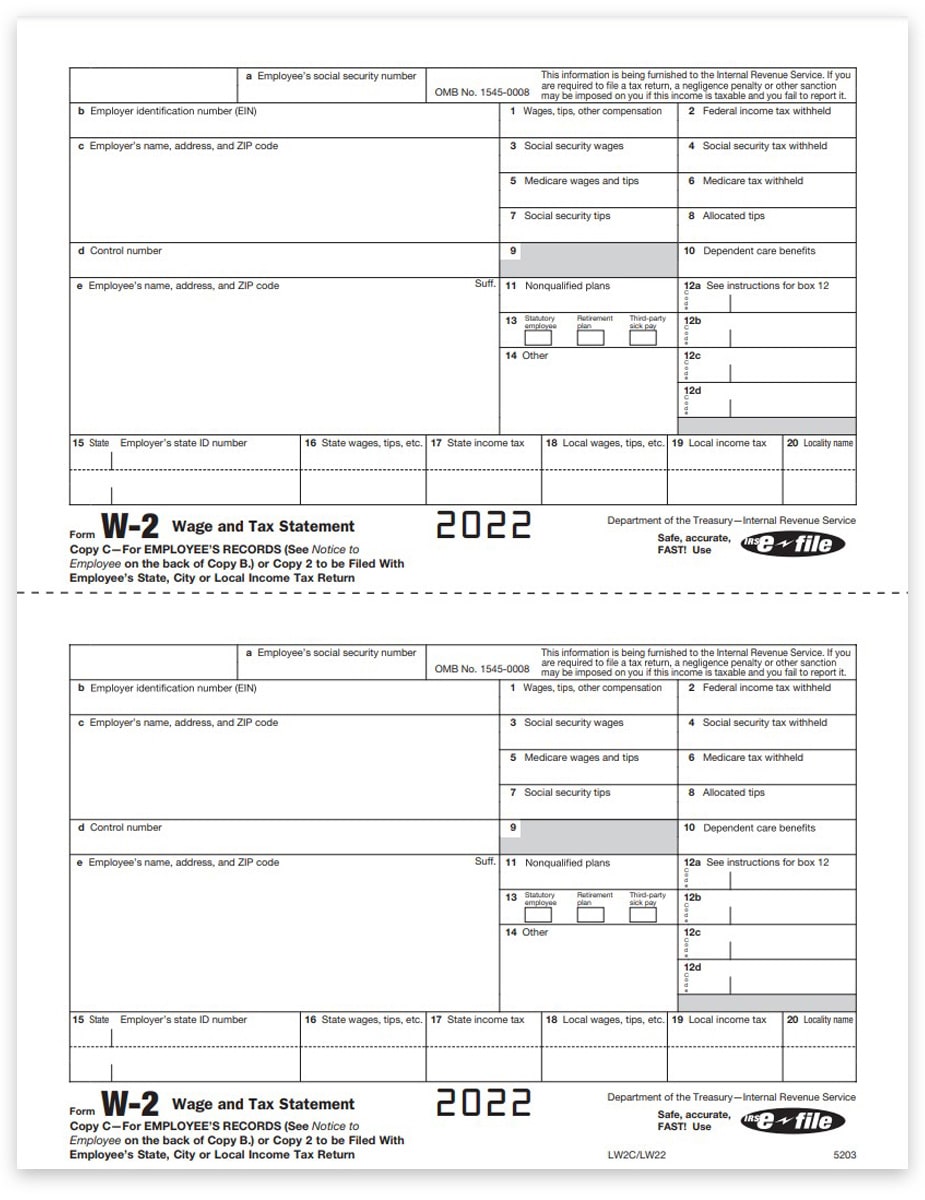

Fillable Form W 2 Printable Forms Free Online

Thankfully, the irs has made it easy for busy workers to file their taxes, even if. You must enter that amount in the federal wages field using the appropriate state. No, if you worked in two different states the amounts in box 16 should be.

Understanding Your IRS Form W2

You must enter that amount in the federal wages field using the appropriate state. No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if.

W2 Tax Forms Copy B for Employee

You must enter that amount in the federal wages field using the appropriate state. No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if.

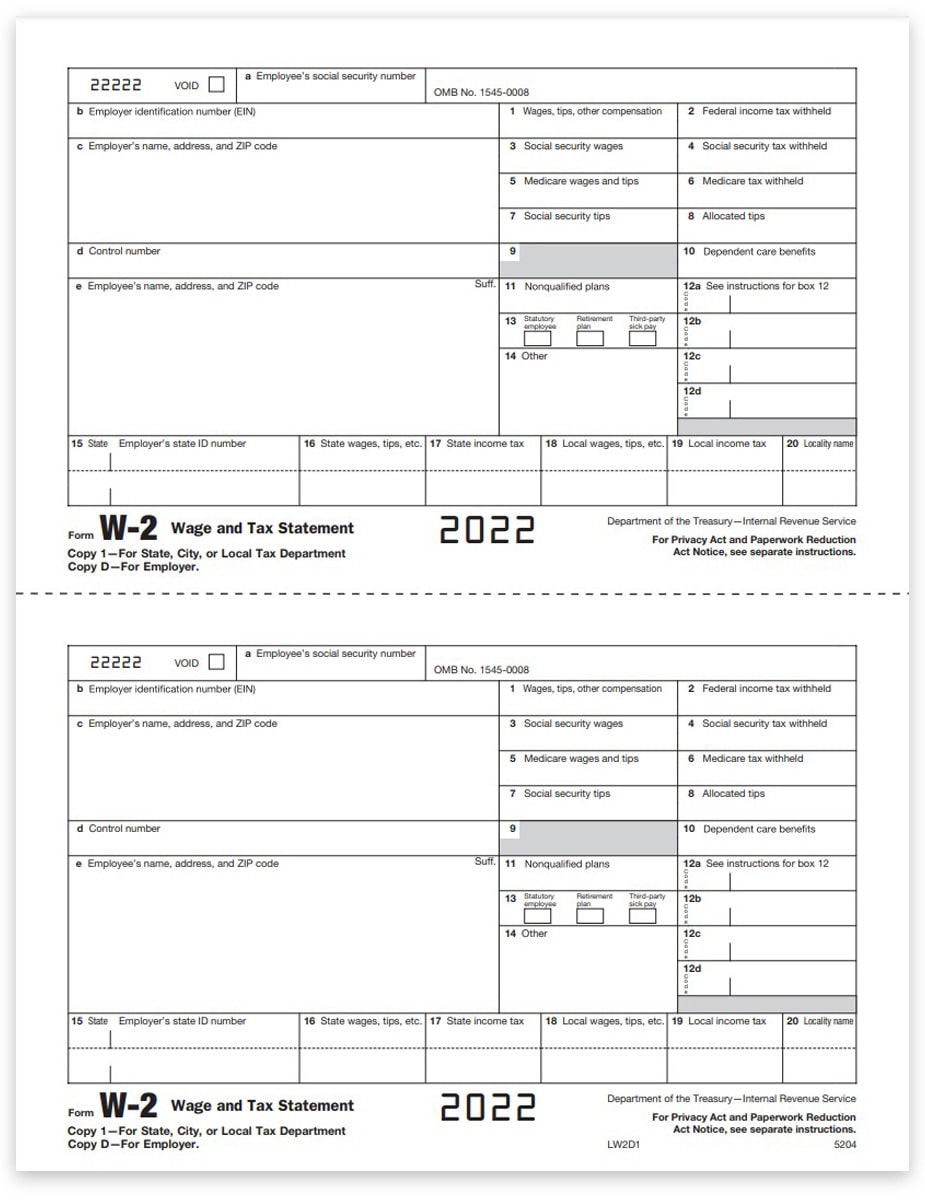

W2 Tax Forms Copy D & 1 for Employer State & File DiscountTaxForms

No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. You must enter that amount in the federal wages field using the appropriate state.

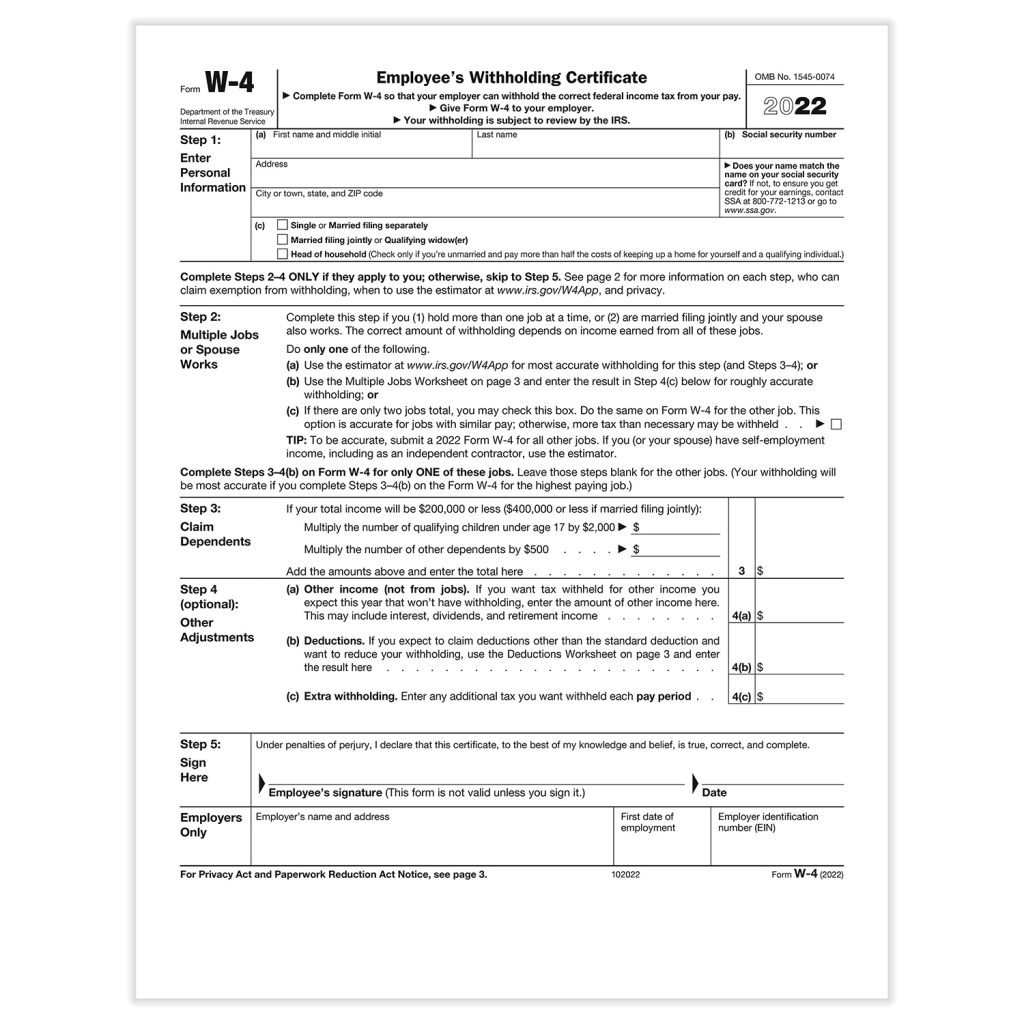

W2 Form 2022 Fillable Form 2024

You must enter that amount in the federal wages field using the appropriate state. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. No, if you worked in two different states the amounts in box 16 should be.

Can You File Two W2 Forms? A guide to All Things W2 Canal HR

You must enter that amount in the federal wages field using the appropriate state. No, if you worked in two different states the amounts in box 16 should be. Thankfully, the irs has made it easy for busy workers to file their taxes, even if.

2023 W2 Printable Form Printable Forms Free Online

Thankfully, the irs has made it easy for busy workers to file their taxes, even if. You must enter that amount in the federal wages field using the appropriate state. No, if you worked in two different states the amounts in box 16 should be.

W2 Forms & Envelopes Set, Official Preprinted Forms DiscountTaxForms

You must enter that amount in the federal wages field using the appropriate state. Thankfully, the irs has made it easy for busy workers to file their taxes, even if. No, if you worked in two different states the amounts in box 16 should be.

Thankfully, The Irs Has Made It Easy For Busy Workers To File Their Taxes, Even If.

No, if you worked in two different states the amounts in box 16 should be. You must enter that amount in the federal wages field using the appropriate state.