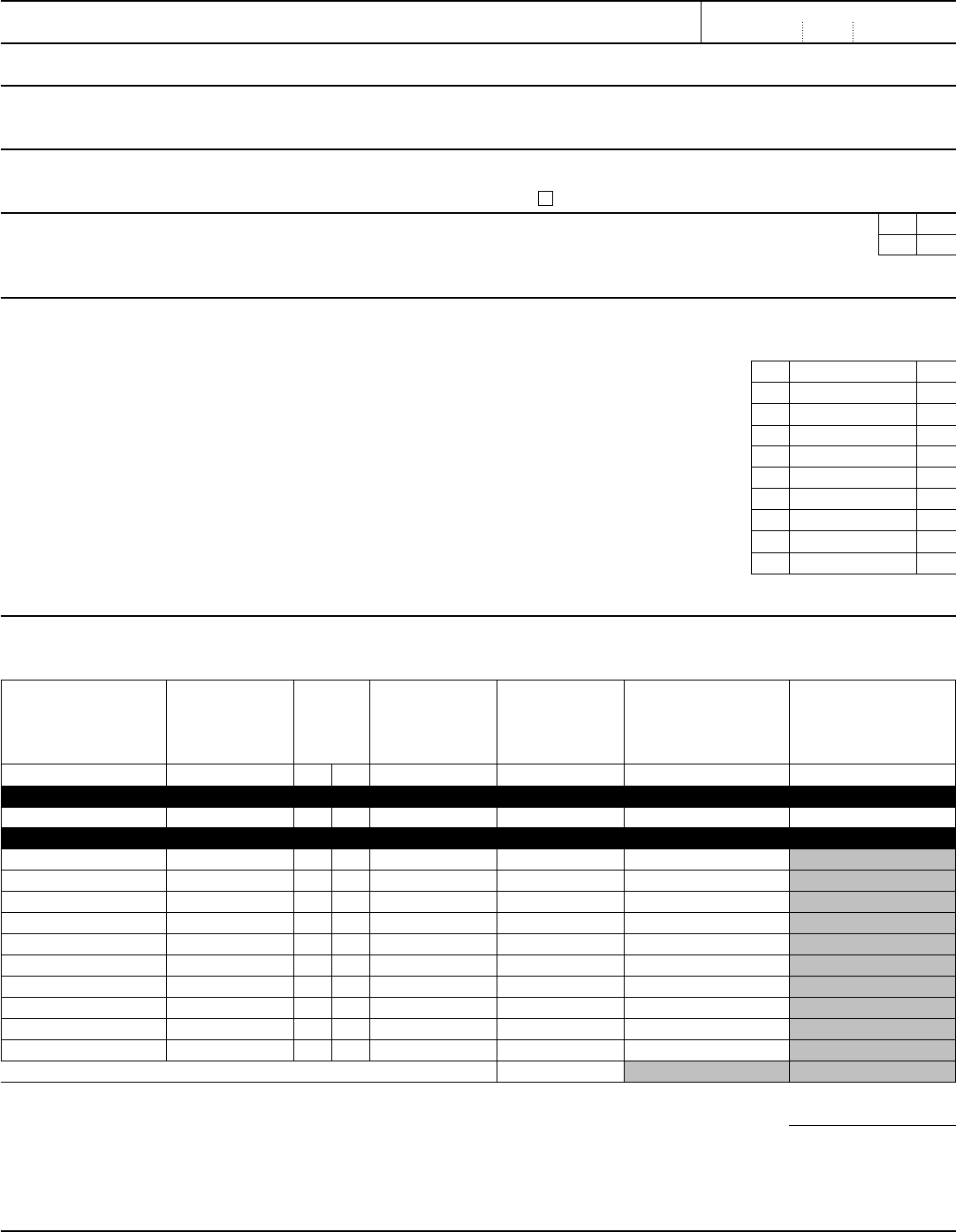

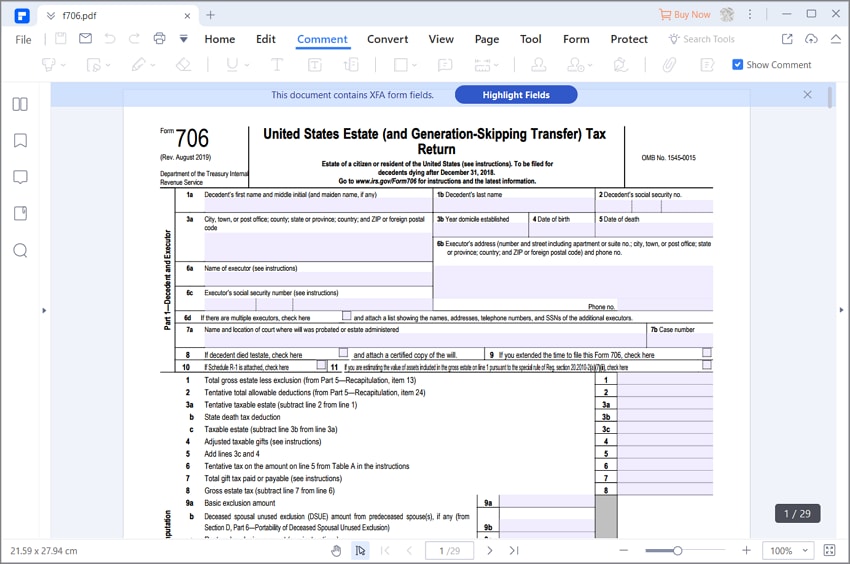

Form 706 Filing Requirements - A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s.

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse.

Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s.

706 Form 2021 IRS Forms Zrivo

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse.

Fillable Online i706na10 Instructions for Form 706NA Department of

A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. Citizen or resident), increased by the decedent’s. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s.

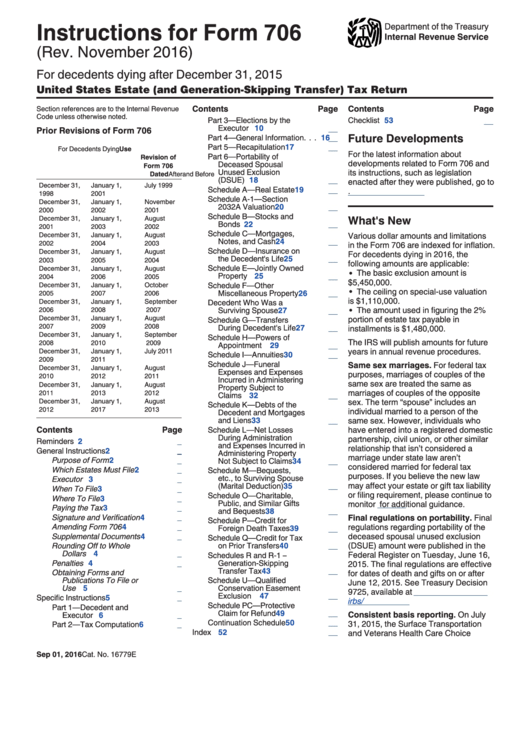

Instructions For Form 706 2016 printable pdf download

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse.

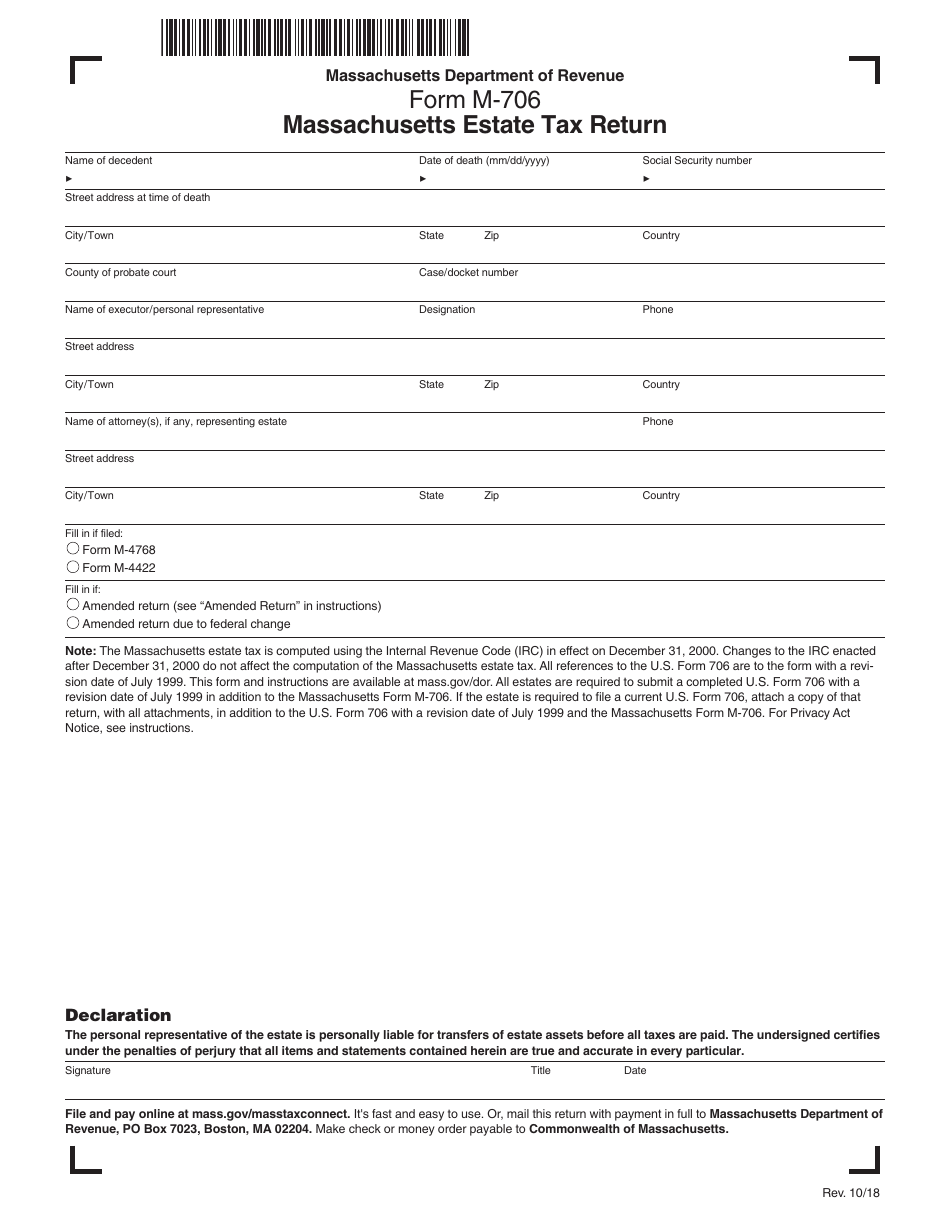

Form M 706 Fillable Printable Forms Free Online

Citizen or resident), increased by the decedent’s. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse.

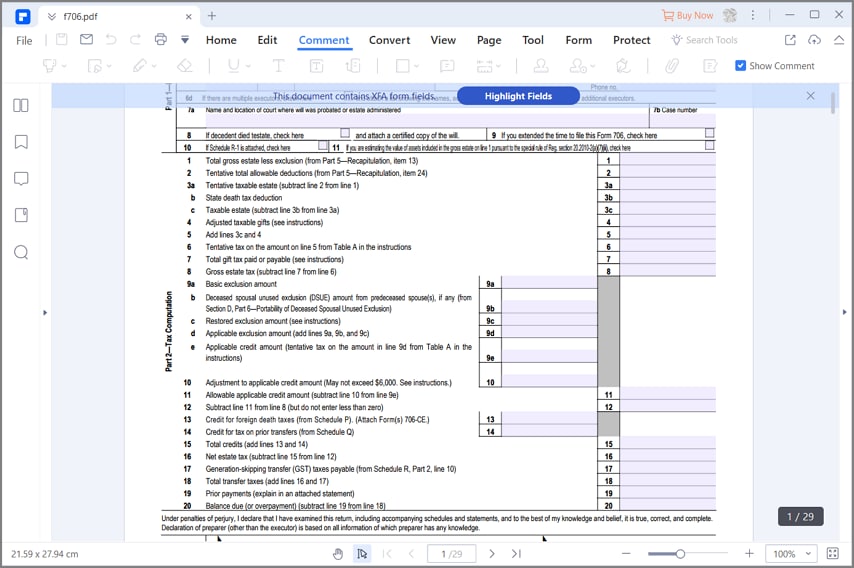

Form 706 Fillable Tax Return Templates in PDF

A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s.

for How to Fill in IRS Form 706

Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s.

Form M 706 Fillable Printable Forms Free Online

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. Citizen or resident), increased by the decedent’s.

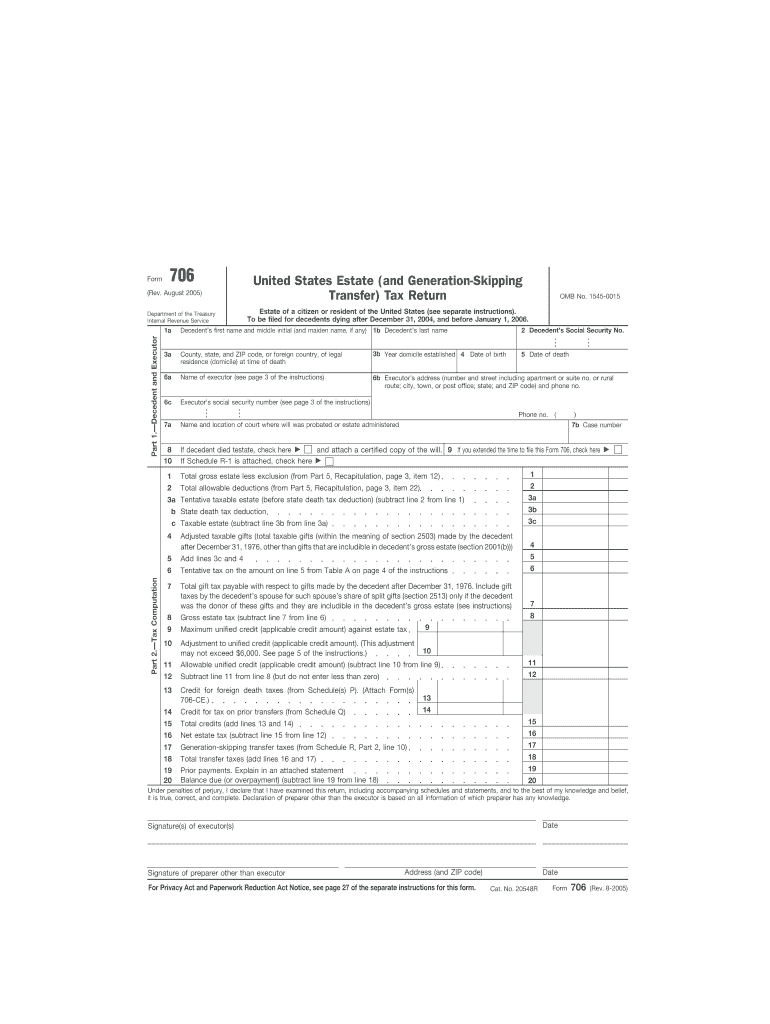

Form 706 Rev August Fill in Capable United States Estate and Generation

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. Citizen or resident), increased by the decedent’s.

Form 706 Edit, Fill, Sign Online Handypdf

Citizen or resident), increased by the decedent’s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s.

Form 706 2023 Printable Forms Free Online

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. A timely filed and complete form 706 is required to elect portability of the dsue amount to a surviving spouse. Citizen or resident), increased by the decedent’s.

A Timely Filed And Complete Form 706 Is Required To Elect Portability Of The Dsue Amount To A Surviving Spouse.

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by the decedent’s.