Form 211 Irs - Application for award for original information created date: A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award.

Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award. You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Application for award for original information created date: A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required.

You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Application for award for original information created date: Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award.

Form 211 Edit, Fill, Sign Online Handypdf

A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Application for award for original information created date: Form 211 is an application for whistleblowers who want to claim a.

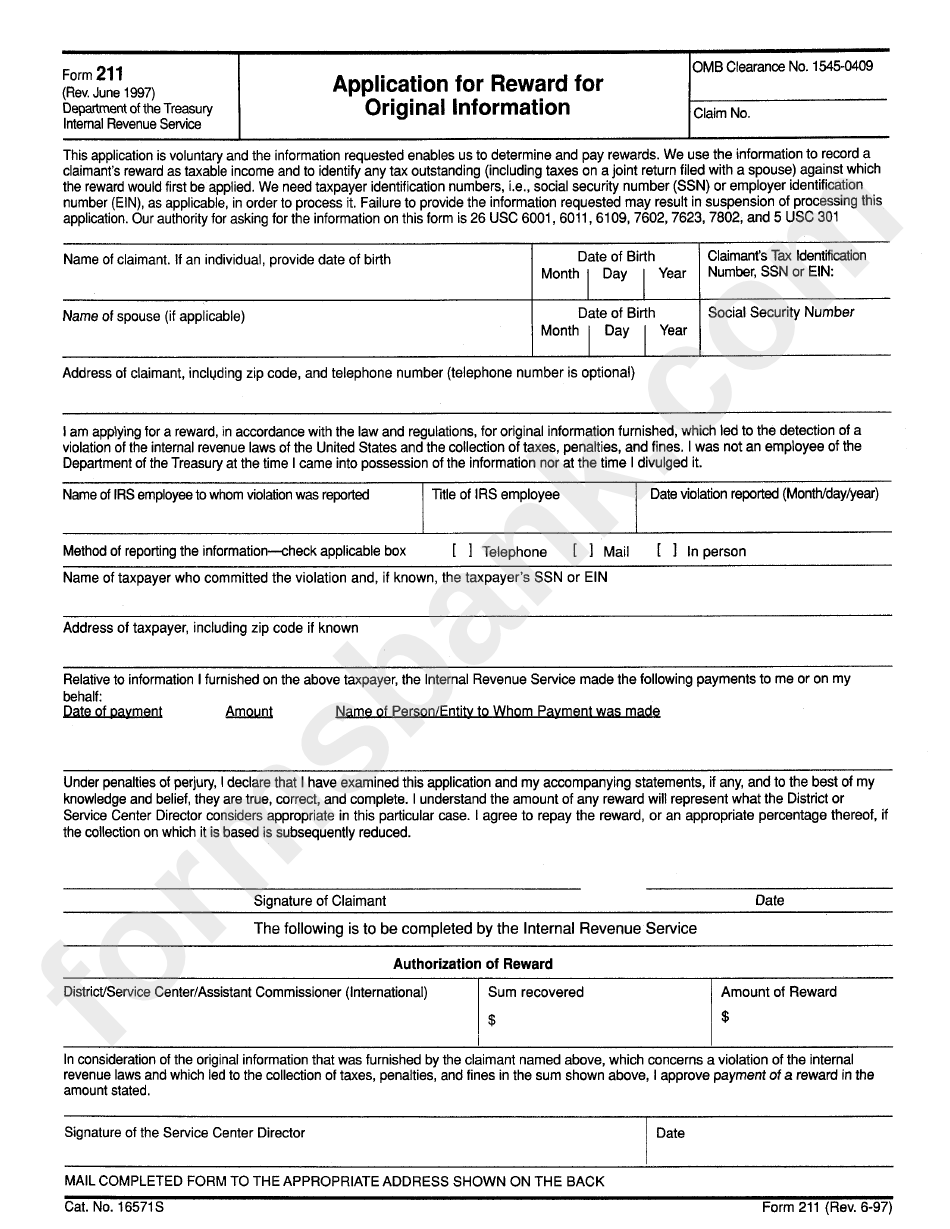

Form 211 Application for Award for Original Information (2014) Free

Application for award for original information created date: Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award. You may not have the adobe reader.

Irs form 3949a 2024 Fill online, Printable, Fillable Blank

Application for award for original information created date: A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award. Form 211 is an application for whistleblowers who want.

What is IRS Form 211?

A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Learn how to submit a claim for award using irs form 211, application for award for original information, and what.

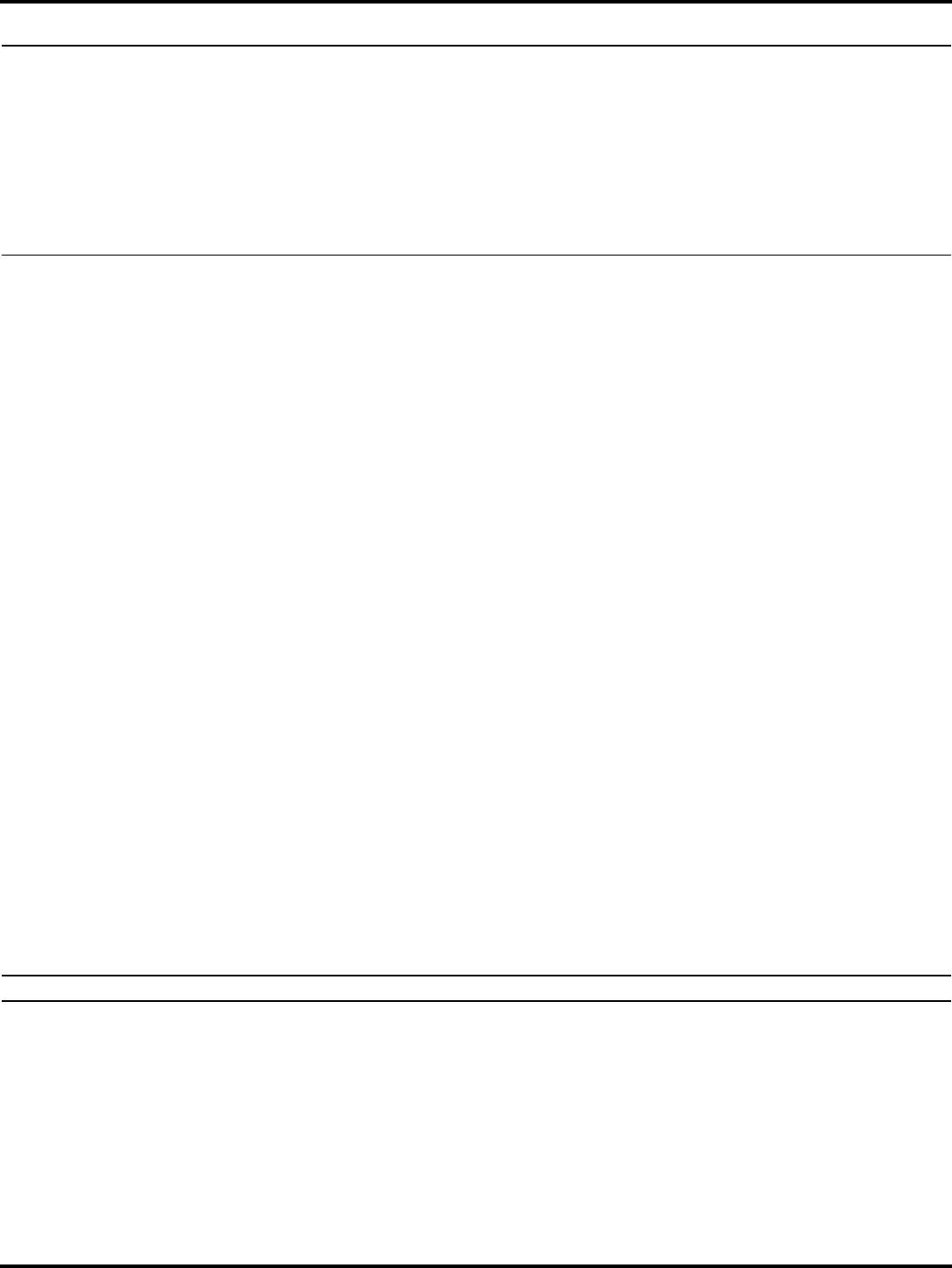

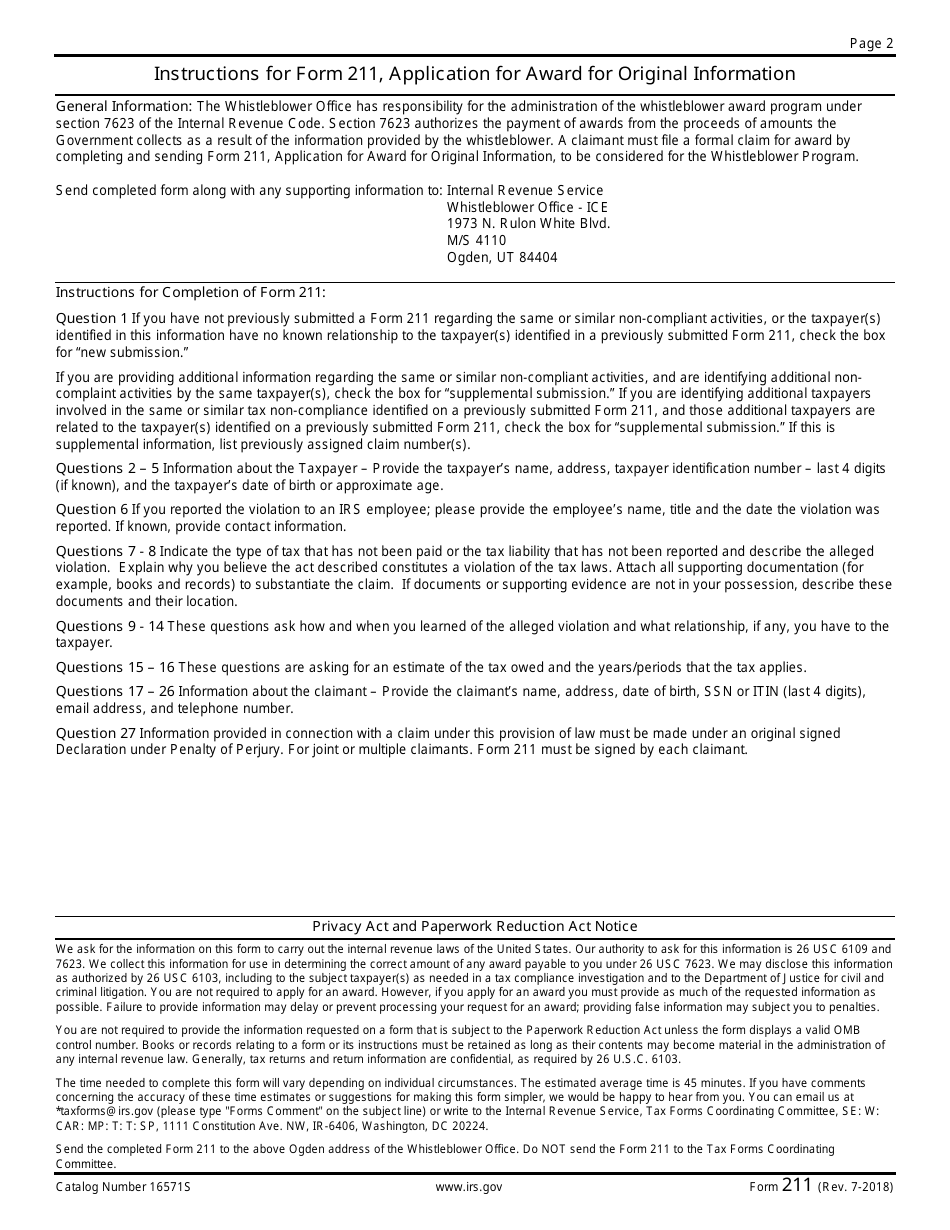

Form 211 Application For Reward For Original Information printable

Application for award for original information created date: You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award. A form 211 helps the whistleblower office.

IRS Form 211 Fill Out, Sign Online and Download Fillable PDF

Application for award for original information created date: A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Learn how to submit a claim for award using irs form 211,.

Child Support IRS Form 211 Whistleblower Award Issued YouTube

A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. Learn how to submit a claim for award using irs form 211, application for award for original information, and what.

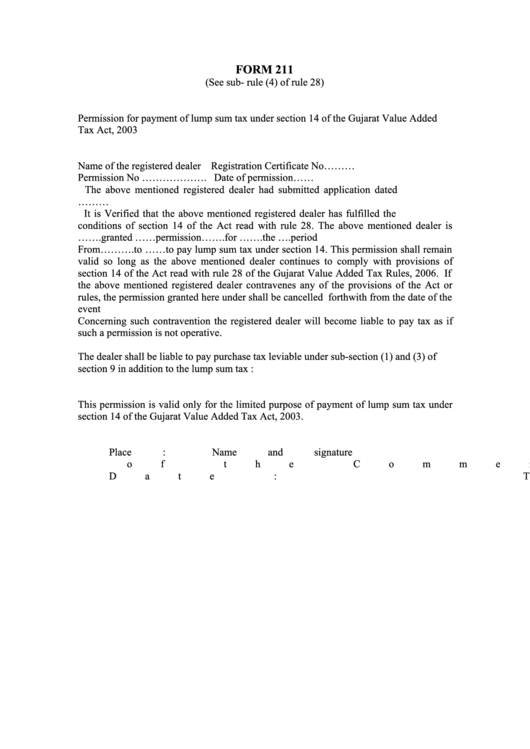

Form 211 Commercial Tax printable pdf download

You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not.

211 Form Fill Online, Printable, Fillable, Blank pdfFiller

You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader. Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not.

IRS Form 211 Instructions

A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Application for award for original information created date: Form 211 is an application for whistleblowers who want to claim a reward for providing information about tax evasion to the. You may not have the adobe reader installed or your viewing environment.

Form 211 Is An Application For Whistleblowers Who Want To Claim A Reward For Providing Information About Tax Evasion To The.

Learn how to submit a claim for award using irs form 211, application for award for original information, and what qualifies for an award. A form 211 helps the whistleblower office and the irs in evaluating a supplemental submission, but is not required. Application for award for original information created date: You may not have the adobe reader installed or your viewing environment may not be properly configured to use adobe reader.