Financial Managers Should Only Accept Investment Projects That - Financial managers should only accept investment projects that: Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that: Increase the current profits of the firm b. Earn a higher rate of return than shareholders can get by investing.

Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects that: Financial managers should only accept investment projects that: Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Increase the current profits of the firm b. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best.

Financial managers should only accept investment projects that: Earn a higher rate of return than shareholders can get by investing. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Increase the current profits of the firm b. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that:

Financial Management for Entrepreneurship and Investment Course

Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that: Increase the current profits of the firm b. Managers should accept all attractive investment opportunities, but some objective or.

Finance for Non Financial Managers Course Simfotix

Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects.

Finance Managers Task, Concept Business and Financial Investment Stock

Financial managers should only accept investment projects that: Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Earn a higher rate of return than shareholders can get by.

Investment Strategies for Financial Managers in Nigeria

Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects that: Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that: Increase the current profits of the firm b.

Alternative Investment Fund Managers Christina Insights

Increase the current profits of the firm b. Financial managers should only accept investment projects that: Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Earn a higher rate of return than shareholders can get by investing. Managers should accept all attractive investment opportunities, but some objective or.

List of The Best Investment Projects ExpoDisplays

Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that: Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Earn a higher rate of return than shareholders can get by.

Finance for NonFinancial Managers

Increase the current profits of the firm b. Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Financial managers should only accept investment projects that: Financial managers should only accept investment projects that: Earn a higher rate of return than shareholders can get by investing.

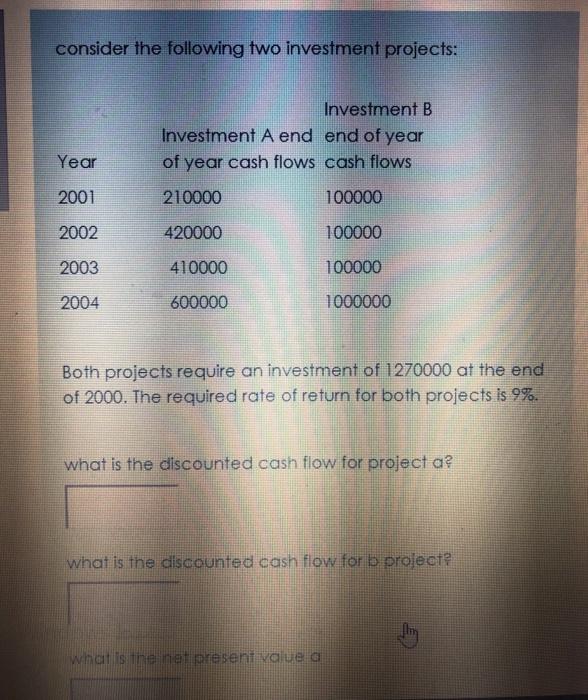

Solved consider the following two investment projects

Financial managers should only accept investment projects that: Earn a higher rate of return than shareholders can get by investing. Increase the current profits of the firm b. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that:

Financial Managers at Work Stock Photo Alamy

Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on its. Financial managers should only accept investment projects that: Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Earn a higher rate of return than shareholders can get by.

The Role of Investment Managers Finance Unlocked

Managers should accept all attractive investment opportunities, but some objective or subjective reasons cause the choice of only the best. Increase the current profits of the firm b. Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects that earn a higher rate of return than the firm currently earns on.

Financial Managers Should Only Accept Investment Projects That Earn A Higher Rate Of Return Than The Firm Currently Earns On Its.

Earn a higher rate of return than shareholders can get by investing. Financial managers should only accept investment projects that: Financial managers should only accept investment projects that: Increase the current profits of the firm b.