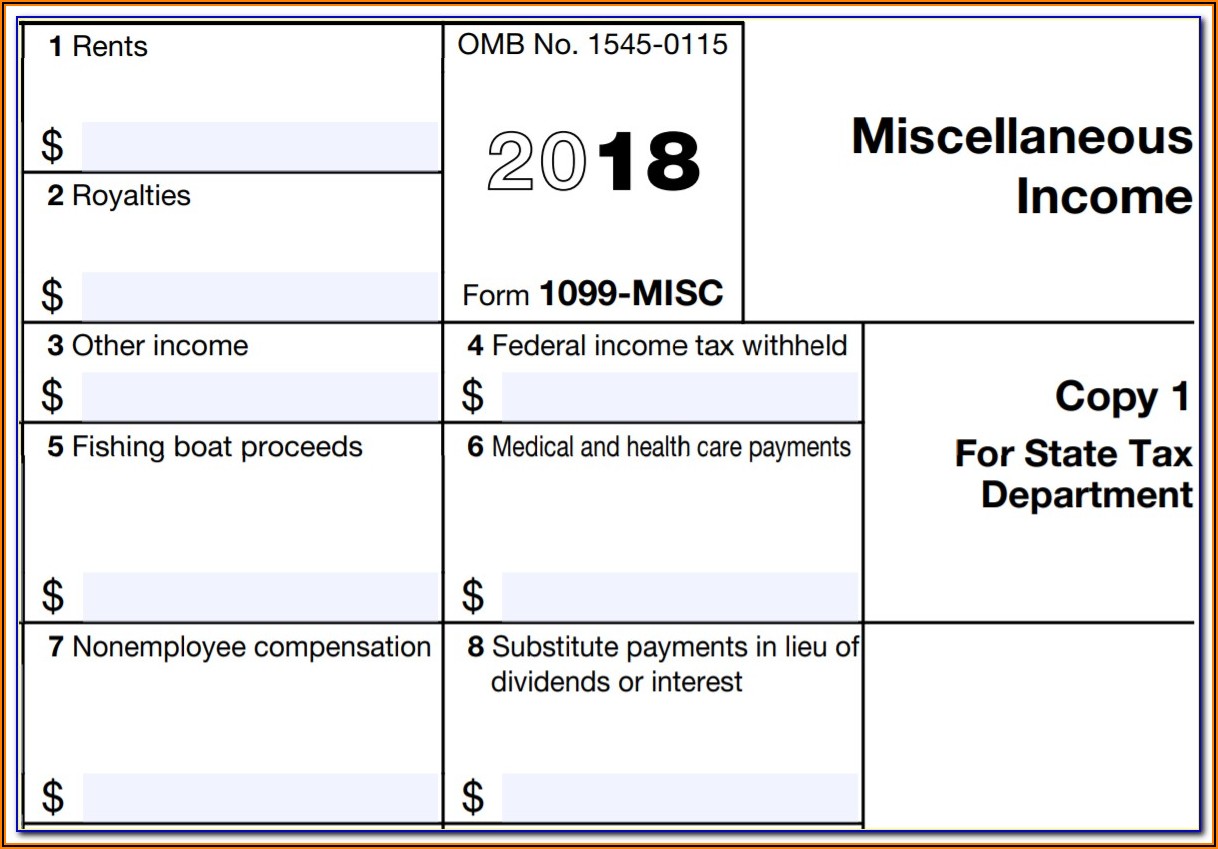

Federal Income Tax Withheld Blank On W2 - In most cases, you do not need to withhold federal income tax from compensation paid to. A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an.

In most cases, you do not need to withhold federal income tax from compensation paid to. A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an.

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

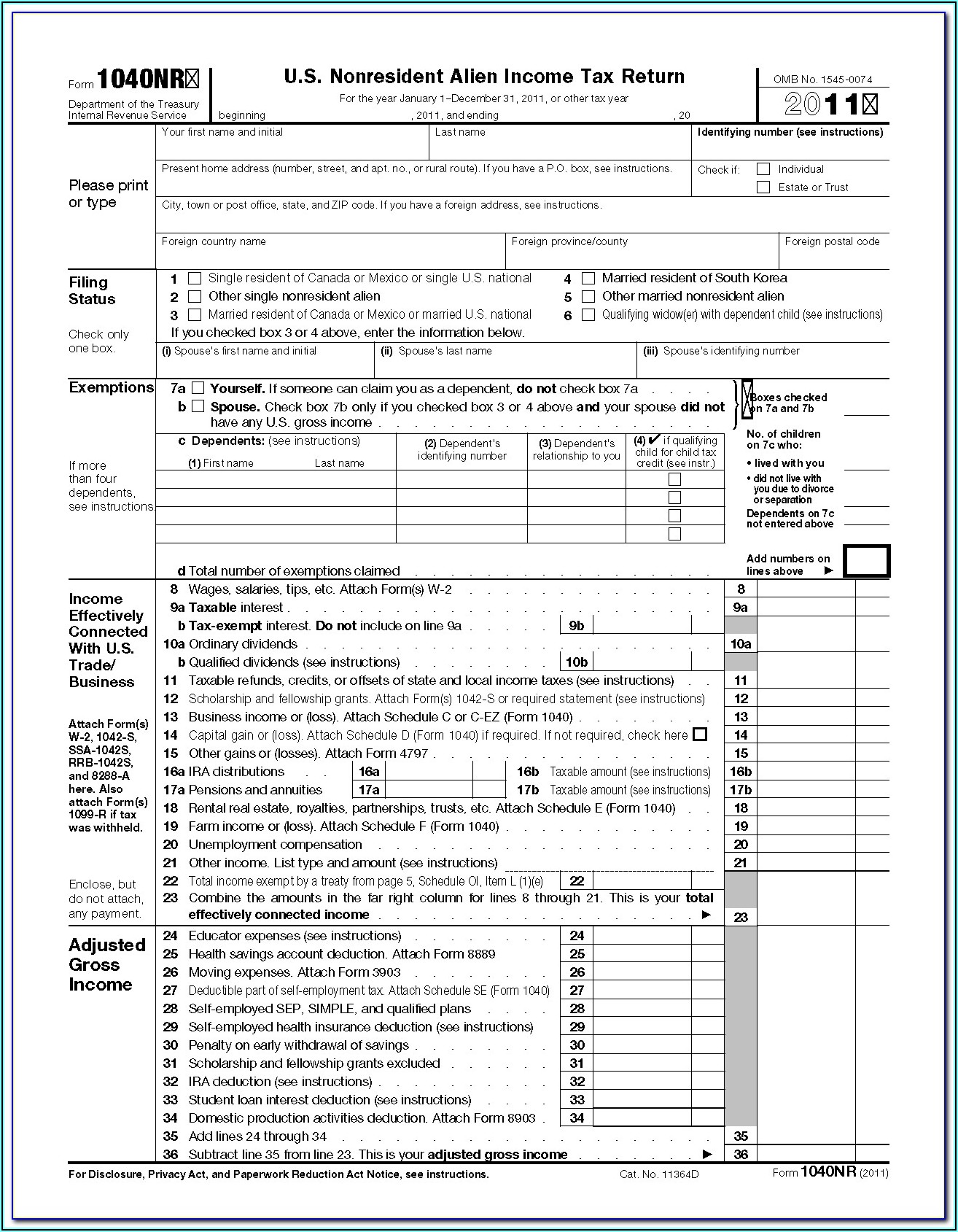

Why Is the Federal Tax Withheld Box Blank on My W2?

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

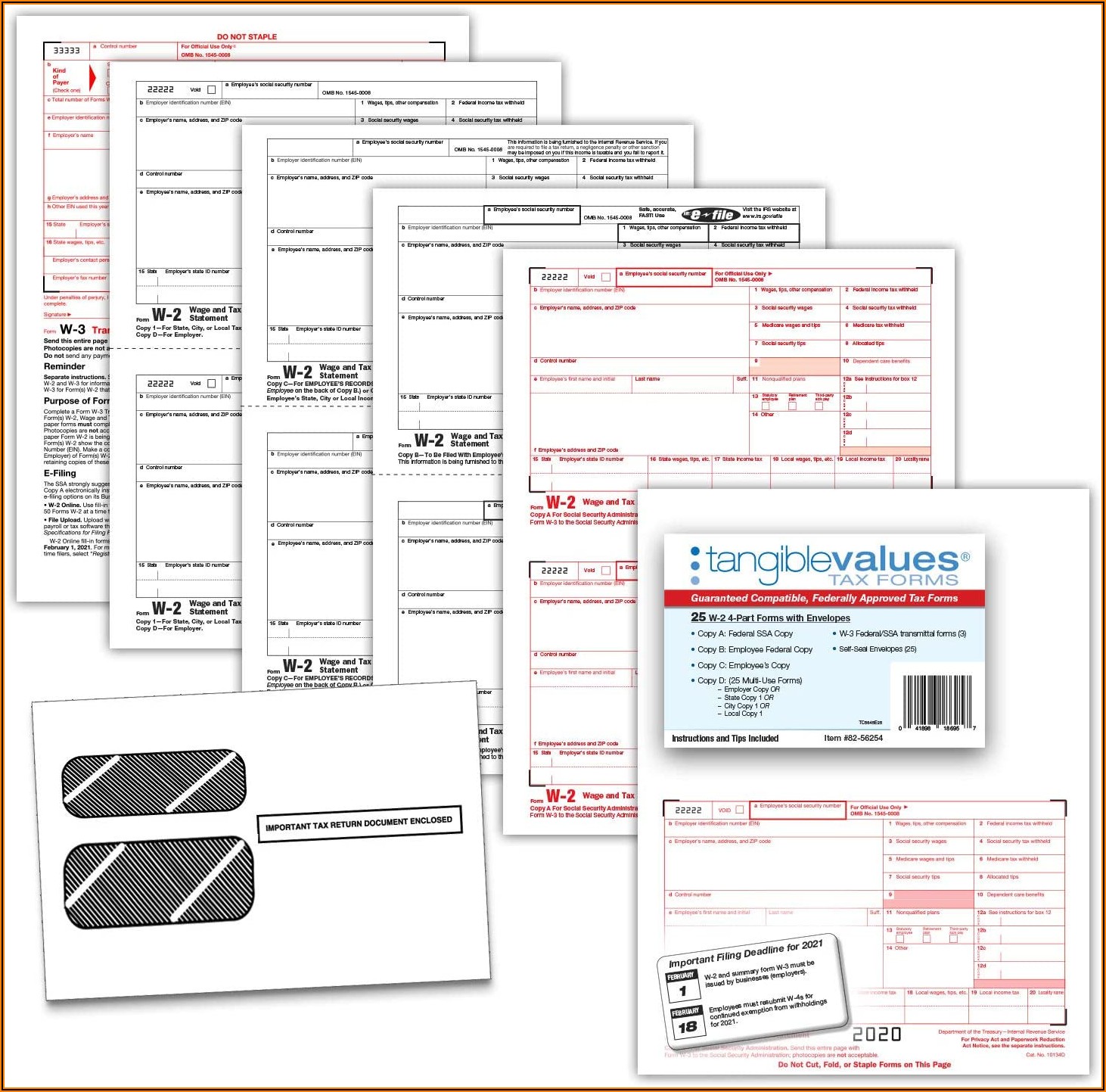

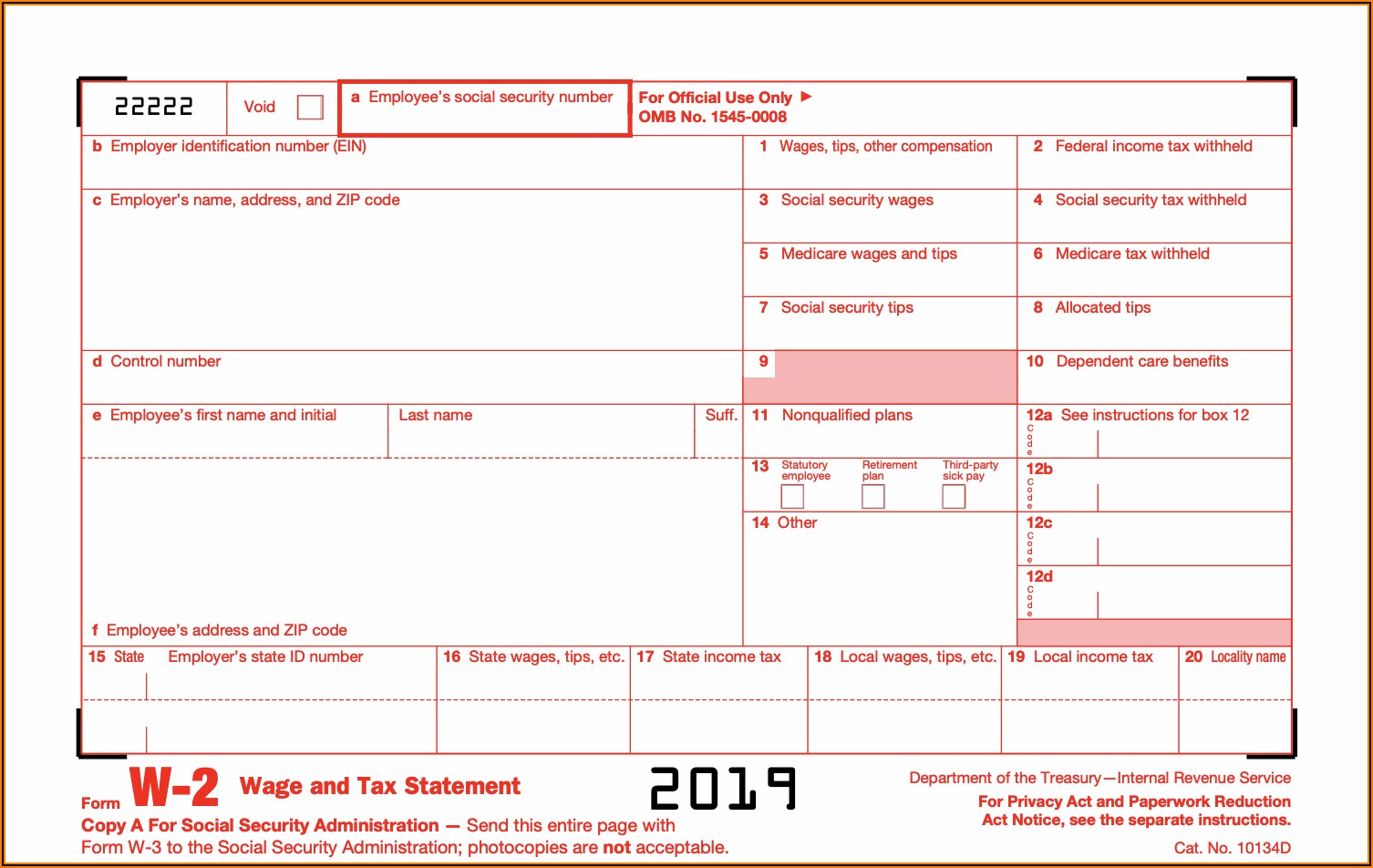

W2 Federal Tax Form Form Resume Examples AjYdX7amYl

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

W2 Form No Federal Tax Withheld Form Resume Examples 1ZV8aR4623

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

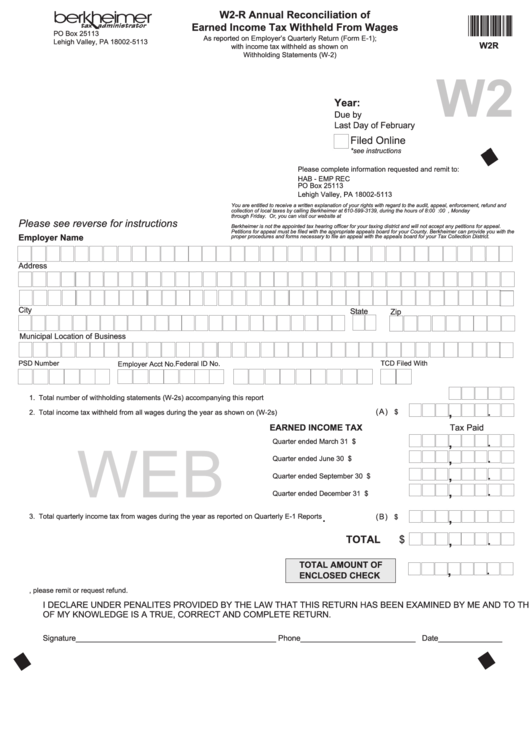

Fillable Form W2R Annual Reconciliation Of Earned Tax

In most cases, you do not need to withhold federal income tax from compensation paid to. A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an.

Why Is the Federal Tax Withheld Box Blank on My W2?

In most cases, you do not need to withhold federal income tax from compensation paid to. A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an.

At What Amount Is Federal Tax Withheld Tax Walls

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

W2 Form Federal Tax Withheld Blank Form Resume Examples

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

W2 Form Federal Tax Withheld Blank Form Resume Examples

In most cases, you do not need to withhold federal income tax from compensation paid to. A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an.

Why Is the Federal Tax Withheld Box Blank on My W2?

A blank federal income tax withheld box might also indicate that you are classified as an independent contractor rather than an. In most cases, you do not need to withhold federal income tax from compensation paid to.

A Blank Federal Income Tax Withheld Box Might Also Indicate That You Are Classified As An Independent Contractor Rather Than An.

In most cases, you do not need to withhold federal income tax from compensation paid to.

/https://blogs-images.forbes.com/kellyphillipserb/files/2014/02/W2.png)