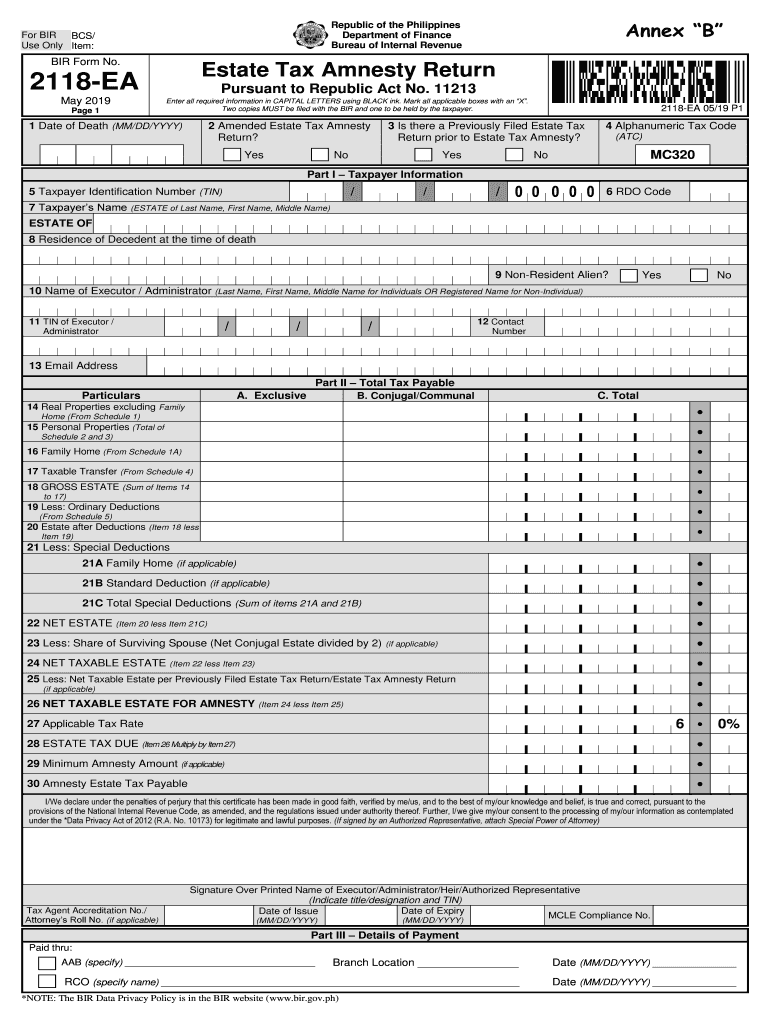

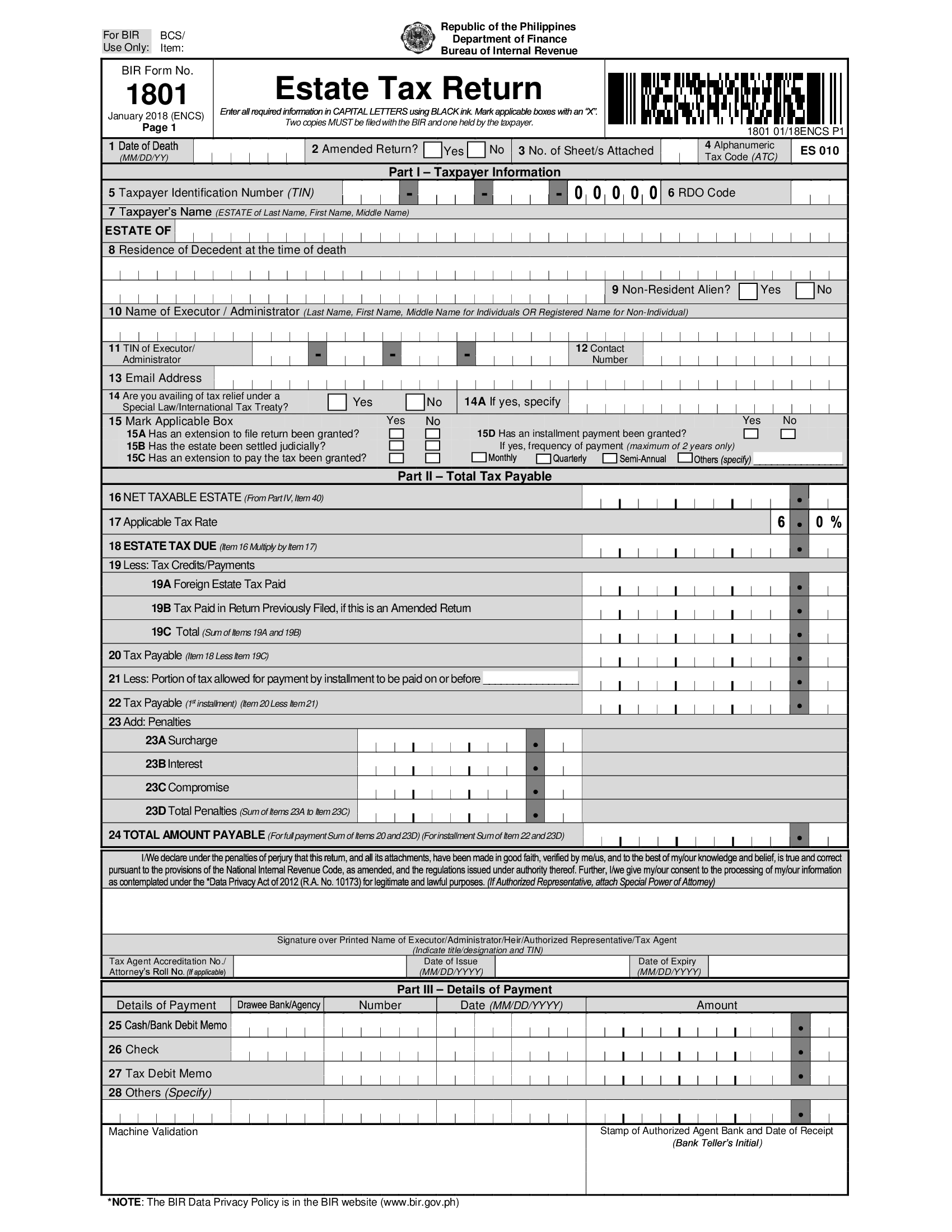

Estate Tax Form Bir - The estate tax amnesty return (etar) (bir form no. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. Estate tax return who shall file this return shall be filed in triplicate by: 1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. 11213 enter all required information in. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. The executor, or administrator, or any of the legal heir/s of the.

When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. 1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. The executor, or administrator, or any of the legal heir/s of the. The estate tax amnesty return (etar) (bir form no. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. Estate tax return who shall file this return shall be filed in triplicate by: 11213 enter all required information in. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan.

When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. 11213 enter all required information in. The estate tax amnesty return (etar) (bir form no. 1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. The executor, or administrator, or any of the legal heir/s of the. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. Estate tax return who shall file this return shall be filed in triplicate by:

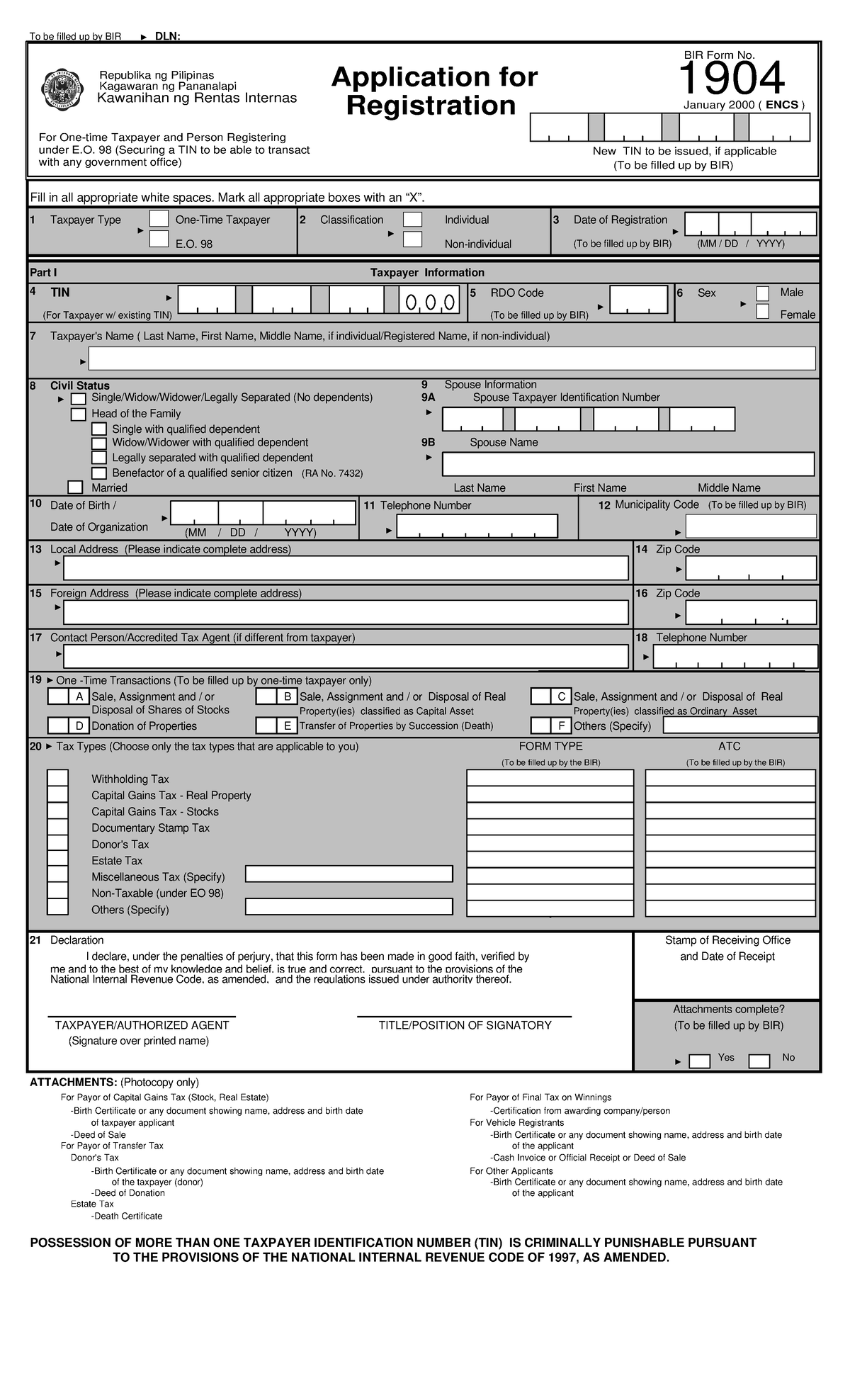

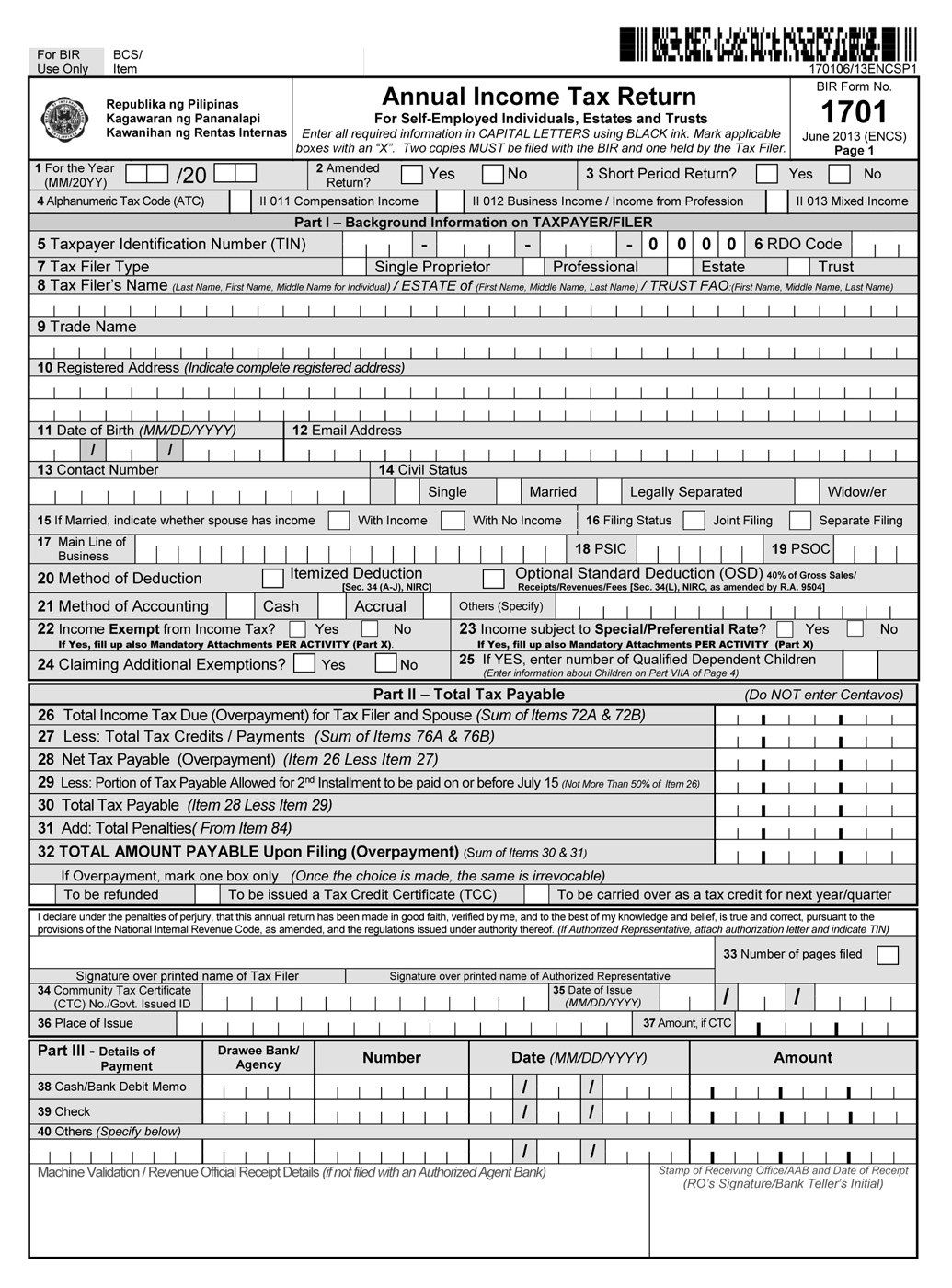

BIRForm1904 Lecture notes 1 To be filled up by BIR DLN Fill in

Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. 1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. 11213 enter all required information in. The executor, or administrator, or any of the legal heir/s of the. It also contains copy of the.

BIRFormNo1801EstateTaxReturn.pdf Estate Tax In The United

Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. The executor, or administrator, or any of the legal heir/s of the. When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. The estate tax amnesty return.

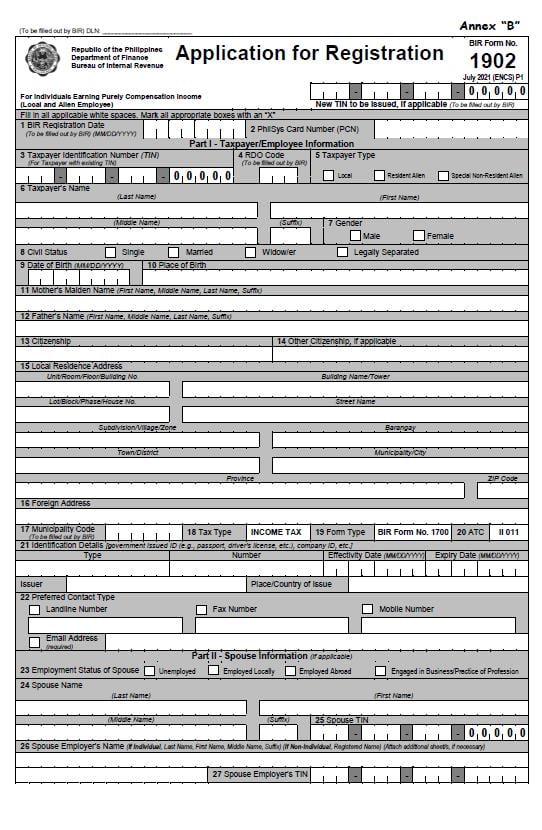

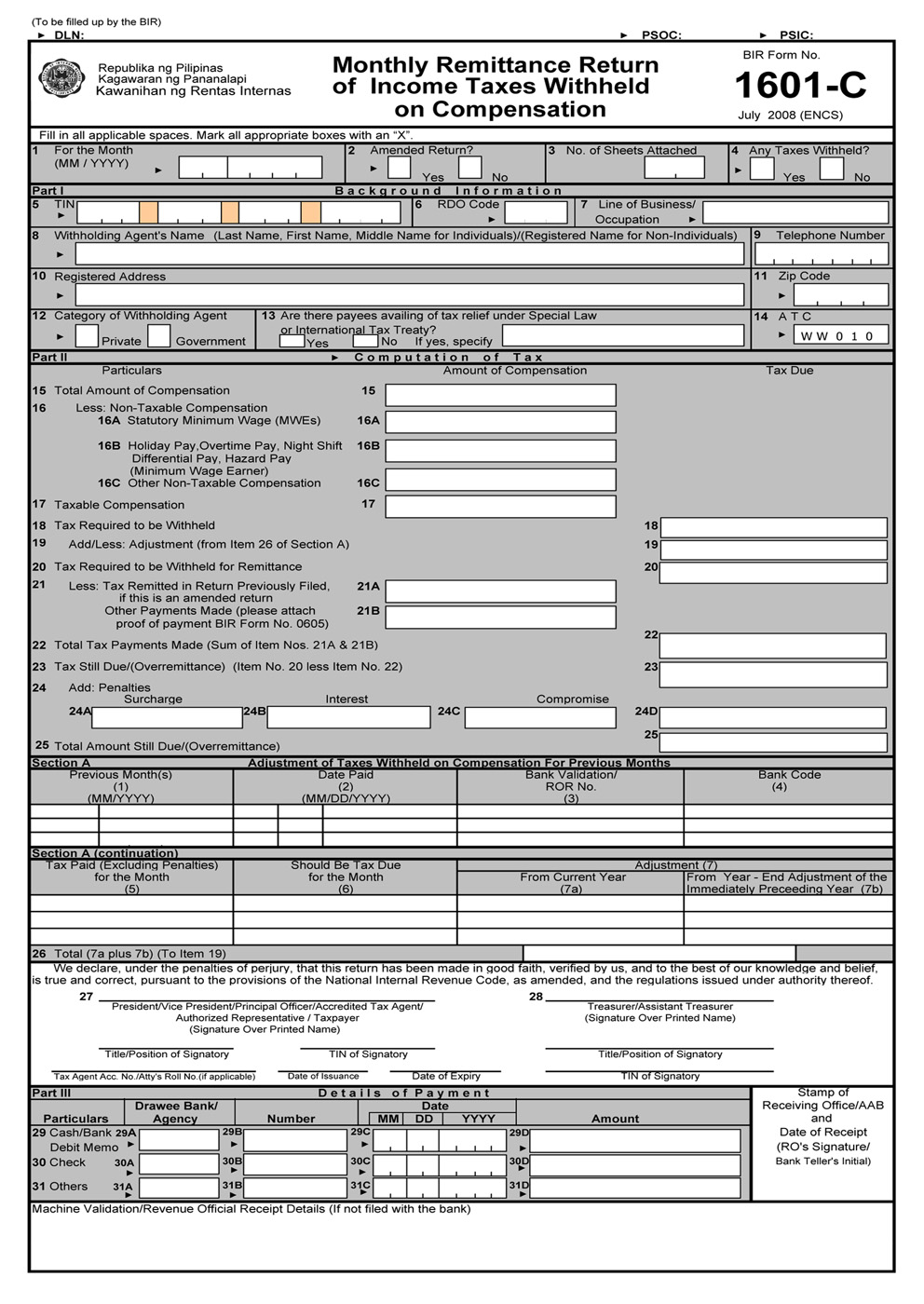

Enhanced BIR registration forms now available Grant Thornton

When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on.

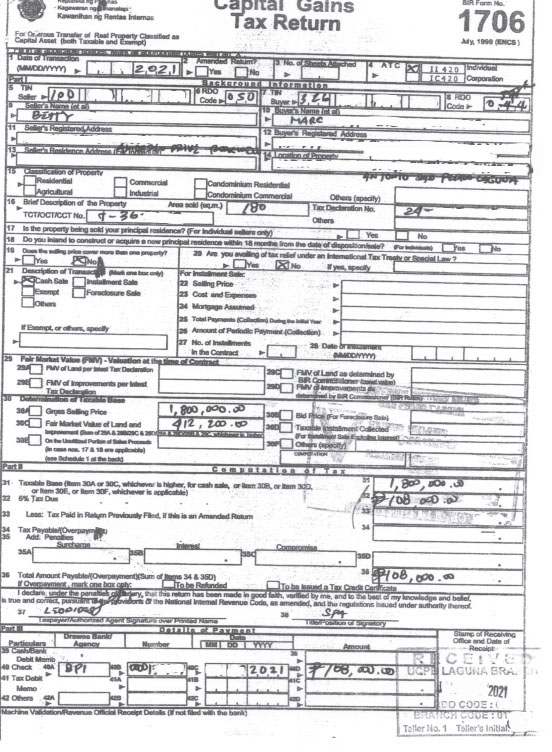

CGT Return BIR Form 1706 The Real Estate Group Philippines

When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. Estate tax return who shall file this return shall be filed in triplicate by: The estate tax.

Estate Tax Amnesty Return Fill and Sign Printable Template Online

Estate tax return who shall file this return shall be filed in triplicate by: Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. The executor, or administrator, or any of the legal heir/s of the. 11213 enter all required information in. When filing the estate tax return in.

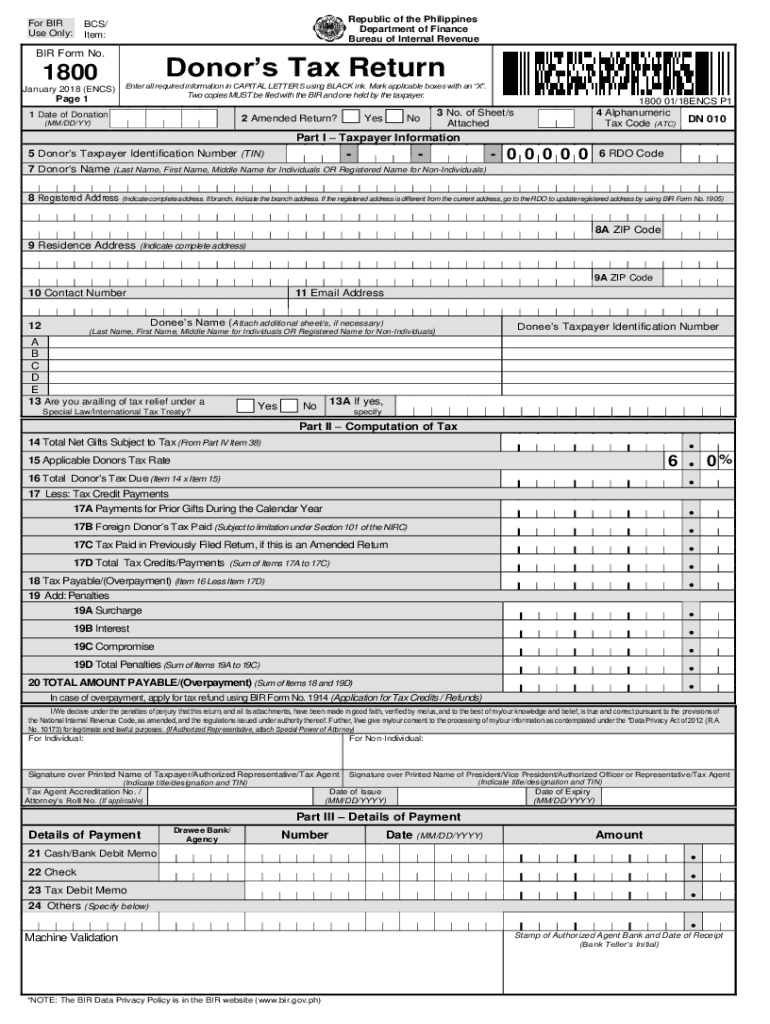

20182024 PH BIR Form 1800 Fill Online, Printable, Fillable, Blank

1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. The estate tax amnesty return (etar) (bir form no. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. 11213 enter all required information in. Estate tax return who shall file this return shall.

Bir Annual Withholding Tax Table 2017 Matttroy

The estate tax amnesty return (etar) (bir form no. 11213 enter all required information in. Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death. It also.

BIR Form 1801. Estate Tax Return Forms Docs 2023

Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. 11213 enter all required.

Bir Tax Table 2017 Pdf Review Home Decor

The estate tax amnesty return (etar) (bir form no. Estate tax return who shall file this return shall be filed in triplicate by: The executor, or administrator, or any of the legal heir/s of the. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. When filing the estate tax.

Bir Routing Slip Form Complete with ease airSlate SignNow

Estate tax return who shall file this return shall be filed in triplicate by: The executor, or administrator, or any of the legal heir/s of the. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 1801 january 2018 (encs) page 1 estate tax return enter all required information in.

The Executor, Or Administrator, Or Any Of The Legal Heir/S Of The.

The estate tax amnesty return (etar) (bir form no. Estate tax return who shall file this return shall be filed in triplicate by: Notice of death duly received by the bir, if gross taxable estate exceeds p20,000 for deaths occurring on or after jan. 11213 enter all required information in.

It Also Contains Copy Of The Tax Code, Bir Forms, Zonal Values Of Real Properties, And Other Tax Information Materials.

1801 january 2018 (encs) page 1 estate tax return enter all required information in capital. When filing the estate tax return in the philippines, you must submit bir form 1801 within one year of the deceased's death.