Double Calendar Spread - The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing.

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush.

Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices.

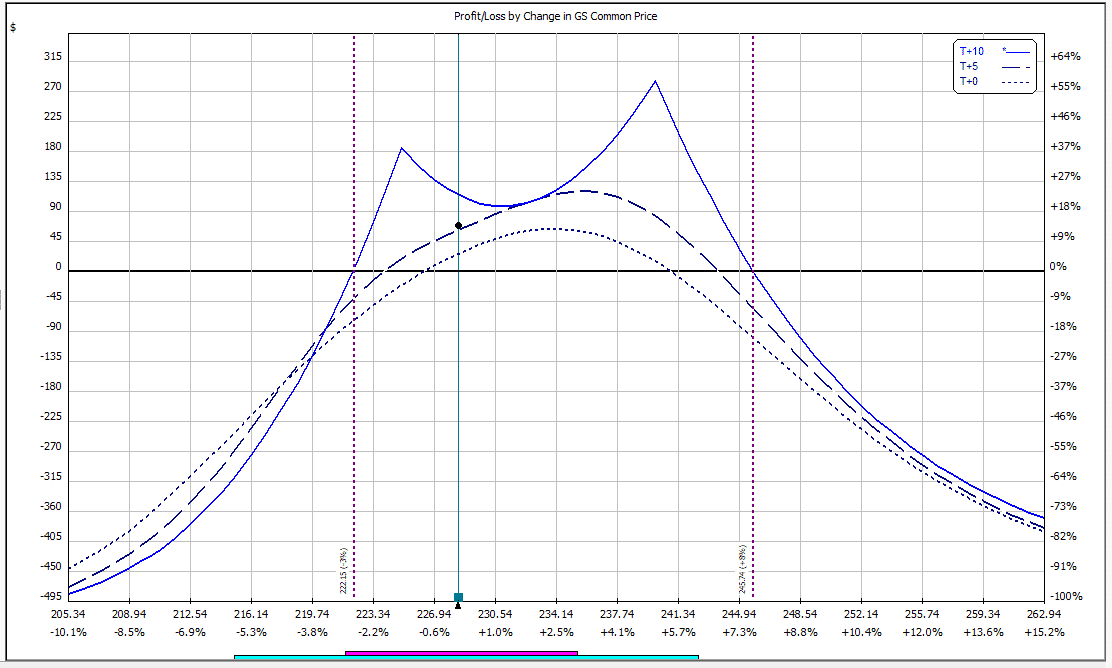

GS double calendar spread Options Trading IQ

The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing.

Double Calendar Spread Strategy Printable Word Searches

The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing.

Double Calendar Spread Weekly Options

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices.

Double Calendar Spread Printable Word Searches

The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing.

Double Calendar Spread Strategy Printable Word Searches

See examples of profitable and losing. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush.

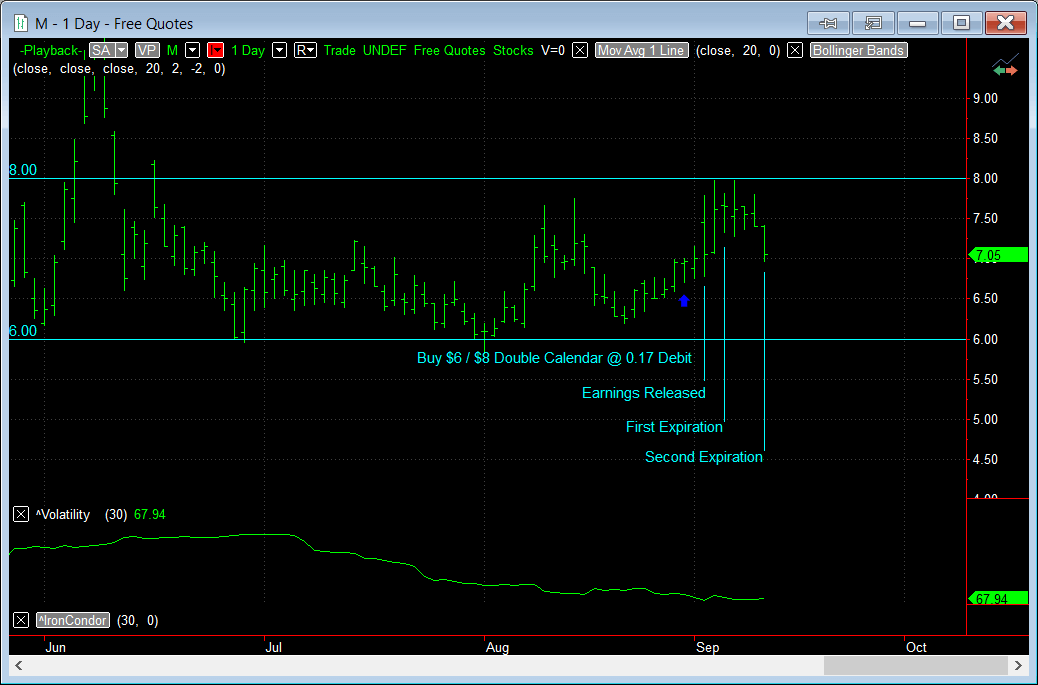

double calendar spread Options Trading IQ

See examples of profitable and losing. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates.

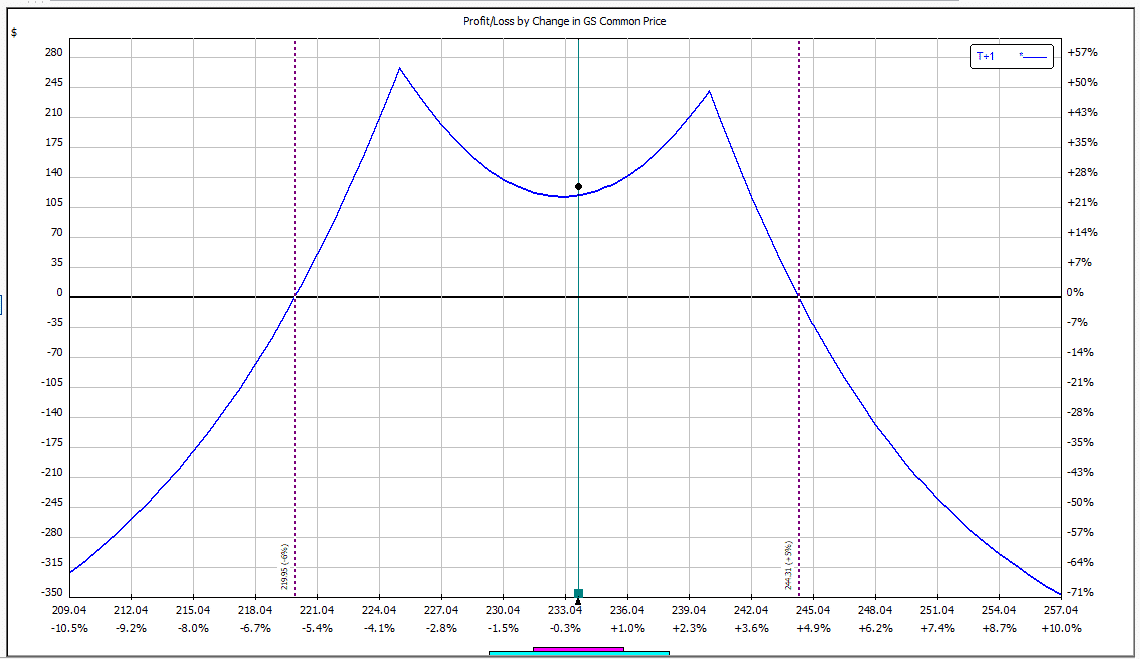

double calendar spread vs double diagonal spread Options Trading IQ

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices.

Double Calendar Spread Weekly Options

The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. See examples of profitable and losing. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush.

Double Calendar Spread Weekly Options

Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates.

Double Calendar Spread

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices.

Learn How To Trade Double Calendar Spreads (Dcs) Around Earnings To Take Advantage Of A Volatility Crush.

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. See examples of profitable and losing. The double calendar spread is simply two calendar spreads tied into a single strategy but at differing strike prices.