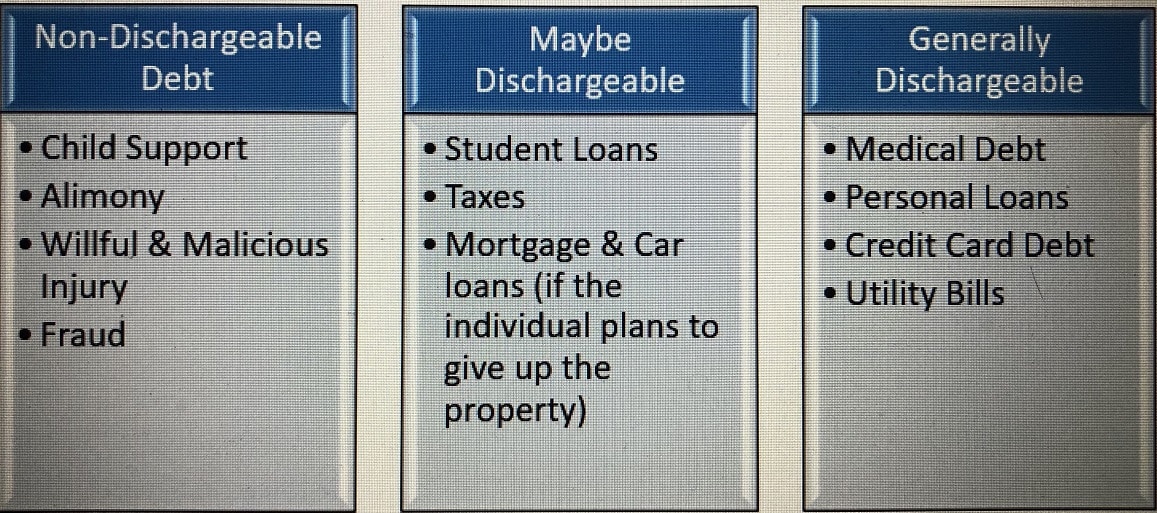

Can Irs Debt Be Discharged In Chapter 11 - A discharge releases you (the debtor). Certain taxes are not discharged, such as trust. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). In a business chapter 11, the debtor receives a discharge upon confirmation of the. What debts can be discharged in a chapter 11 bankruptcy? Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. If you successfully complete your bankruptcy plan you will receive a discharge of debt. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy.

What debts can be discharged in a chapter 11 bankruptcy? Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. A discharge releases you (the debtor). Certain taxes are not discharged, such as trust. If you successfully complete your bankruptcy plan you will receive a discharge of debt. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. In a business chapter 11, the debtor receives a discharge upon confirmation of the.

In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). A discharge releases you (the debtor). If you successfully complete your bankruptcy plan you will receive a discharge of debt. What debts can be discharged in a chapter 11 bankruptcy? Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In a business chapter 11, the debtor receives a discharge upon confirmation of the. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Certain taxes are not discharged, such as trust. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy.

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Certain taxes are not discharged, such as trust. What debts can be discharged in a chapter 11 bankruptcy? A discharge releases you (the debtor). Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities.

Can I Qualify for IRS Debt in Bankruptcy? OakTree Law

In a business chapter 11, the debtor receives a discharge upon confirmation of the. What debts can be discharged in a chapter 11 bankruptcy? Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Certain taxes are not discharged, such as trust. A discharge releases you (the debtor).

Does Chapter 7 wipe out all debt? Leia aqui What debts are not

In a business chapter 11, the debtor receives a discharge upon confirmation of the. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing.

Can back taxes be discharged in chapter 7?

Certain taxes are not discharged, such as trust. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. In order.

Can You File Bankruptcy On IRS Debt?

A discharge releases you (the debtor). What debts can be discharged in a chapter 11 bankruptcy? In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Certain taxes are not discharged, such as trust.

Can IRS debt be discharged in Chapter 13?

Sometimes penalties are discharged but not the taxes for the late filing of a tax return. What debts can be discharged in a chapter 11 bankruptcy? A discharge releases you (the debtor). Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Certain taxes are not discharged, such as trust.

Understanding Debt Discharge in Chapter 7 Bankruptcy What Can and

Certain taxes are not discharged, such as trust. In a business chapter 11, the debtor receives a discharge upon confirmation of the. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. If you successfully complete your bankruptcy plan.

Can your IRS debts expire?

What debts can be discharged in a chapter 11 bankruptcy? Sometimes penalties are discharged but not the taxes for the late filing of a tax return. A discharge releases you (the debtor). Certain taxes are not discharged, such as trust. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8).

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. In order to be dischargeable, the tax debt must meet.

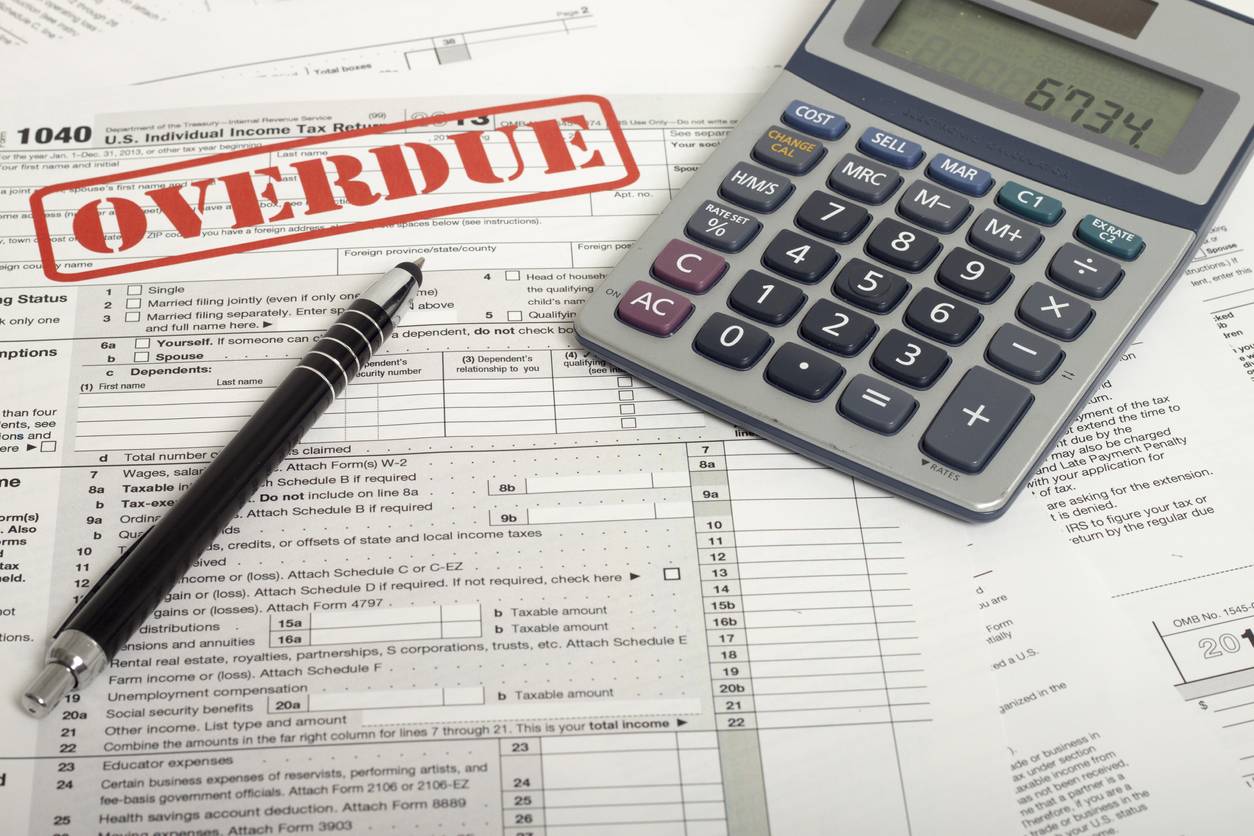

Using Chapter 13 to Deal With Overdue Taxes

In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). If you successfully complete your bankruptcy plan you will receive a discharge of debt. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Irs may keep payments, and time in.

Certain Taxes Are Not Discharged, Such As Trust.

In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. What debts can be discharged in a chapter 11 bankruptcy? A discharge releases you (the debtor). In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8).

Irs May Keep Payments, And Time In Bankruptcy Extends Time To Collect Remaining Tax Liabilities.

If you successfully complete your bankruptcy plan you will receive a discharge of debt. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. In a business chapter 11, the debtor receives a discharge upon confirmation of the.