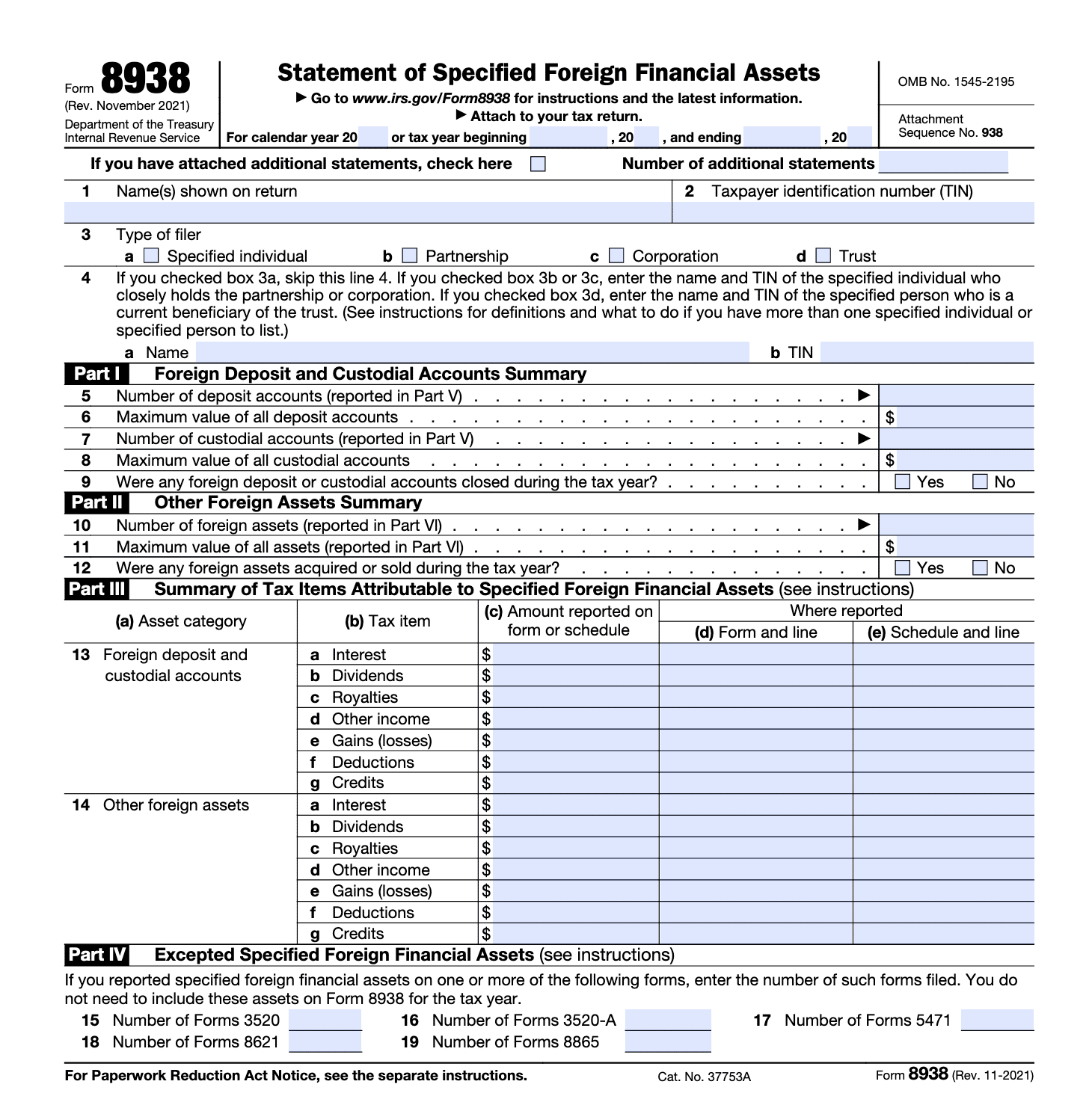

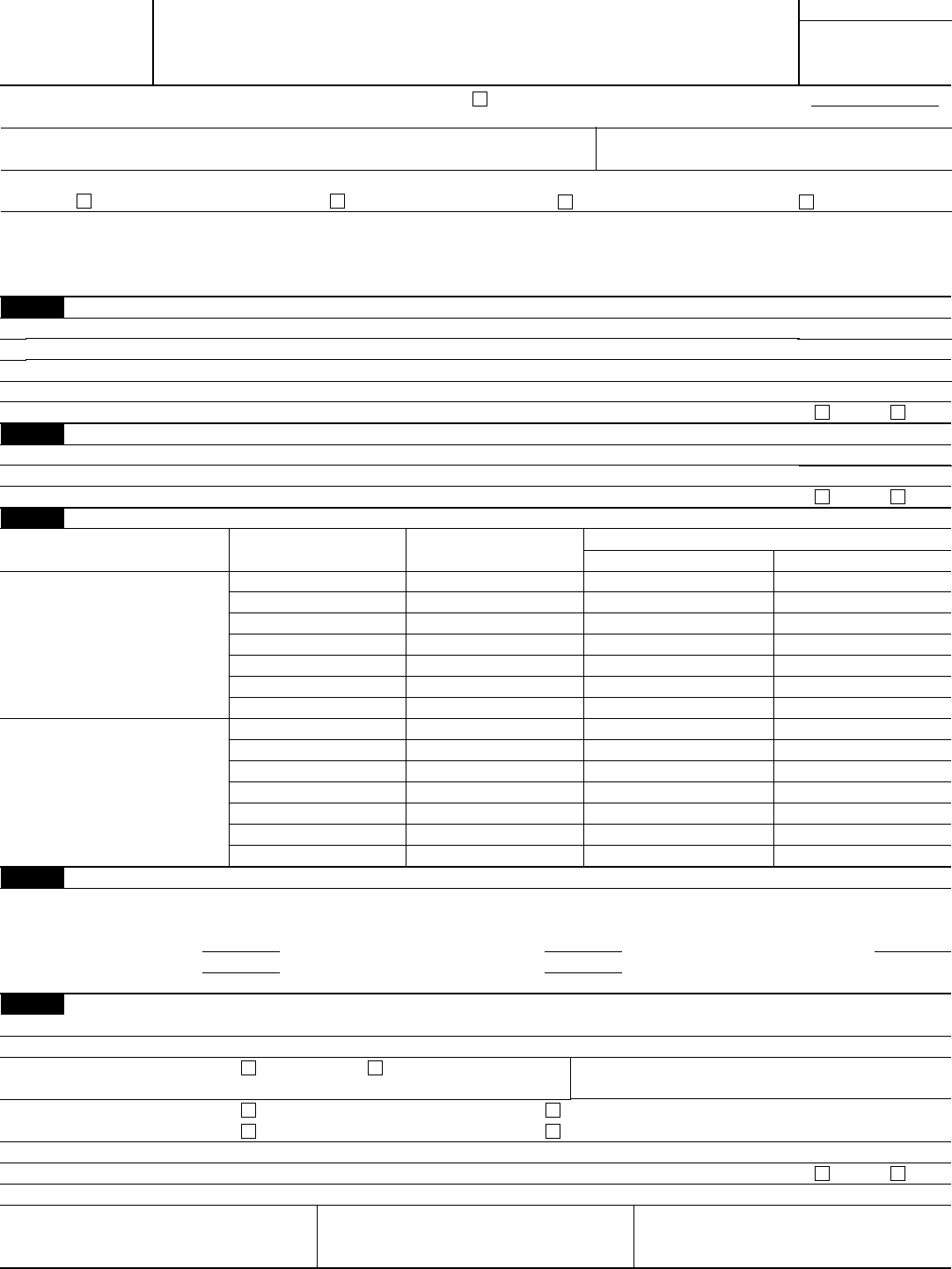

Form 8938 Æ›¸ÃÆ–¹ - Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Tax system, especially for taxpayers who have. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. You do not need to. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938 is filed if the taxpayer: Form 8938 is used to report the taxpayer's specified foreign financial assets.

Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do not need to. Form 8938 is filed if the taxpayer: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Tax system, especially for taxpayers who have. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Form 8938 is used to report the taxpayer's specified foreign financial assets.

Form 8938 is used to report the taxpayer's specified foreign financial assets. Tax system, especially for taxpayers who have. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938 is filed if the taxpayer: Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. You do not need to. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s.

Form 8938 Filing Requirement Tax Strategies Motley Fool Community

If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938 is used to report the taxpayer's specified foreign financial assets. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Tax system,.

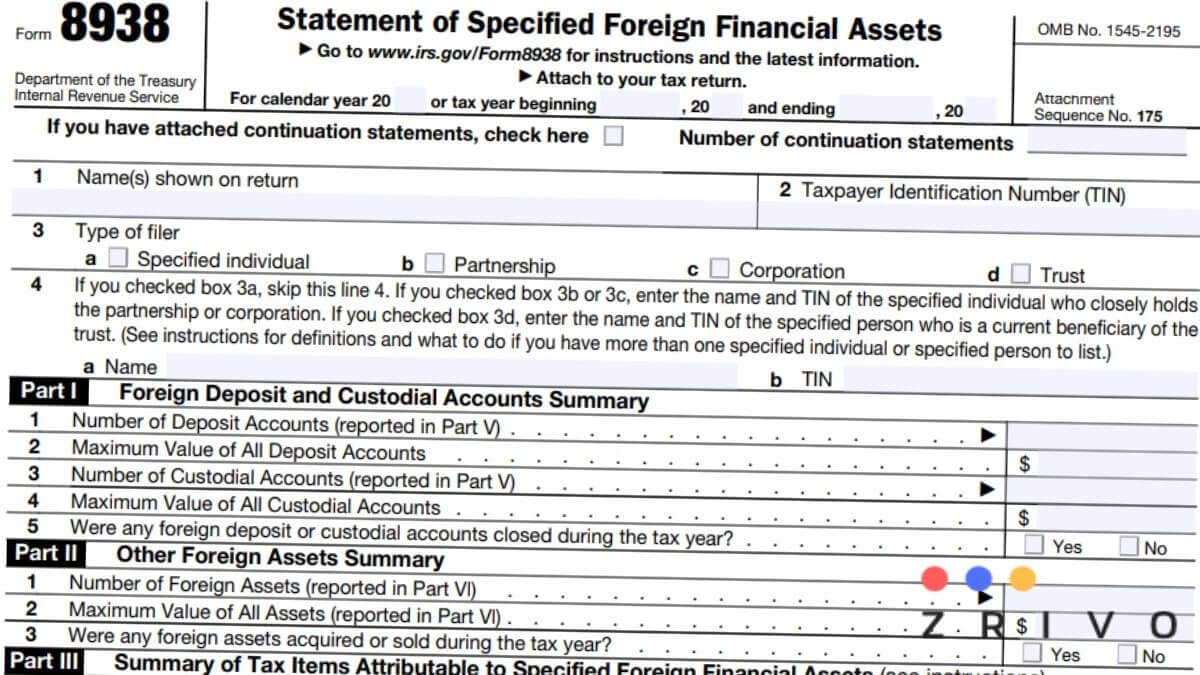

Form 8938 Instructions Do You Need to Report? GlobalBanks

Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms.

form 8938 vs fbar Fill Online, Printable, Fillable Blank form8938

You do not need to. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938 is filed if the taxpayer: Form 8938.

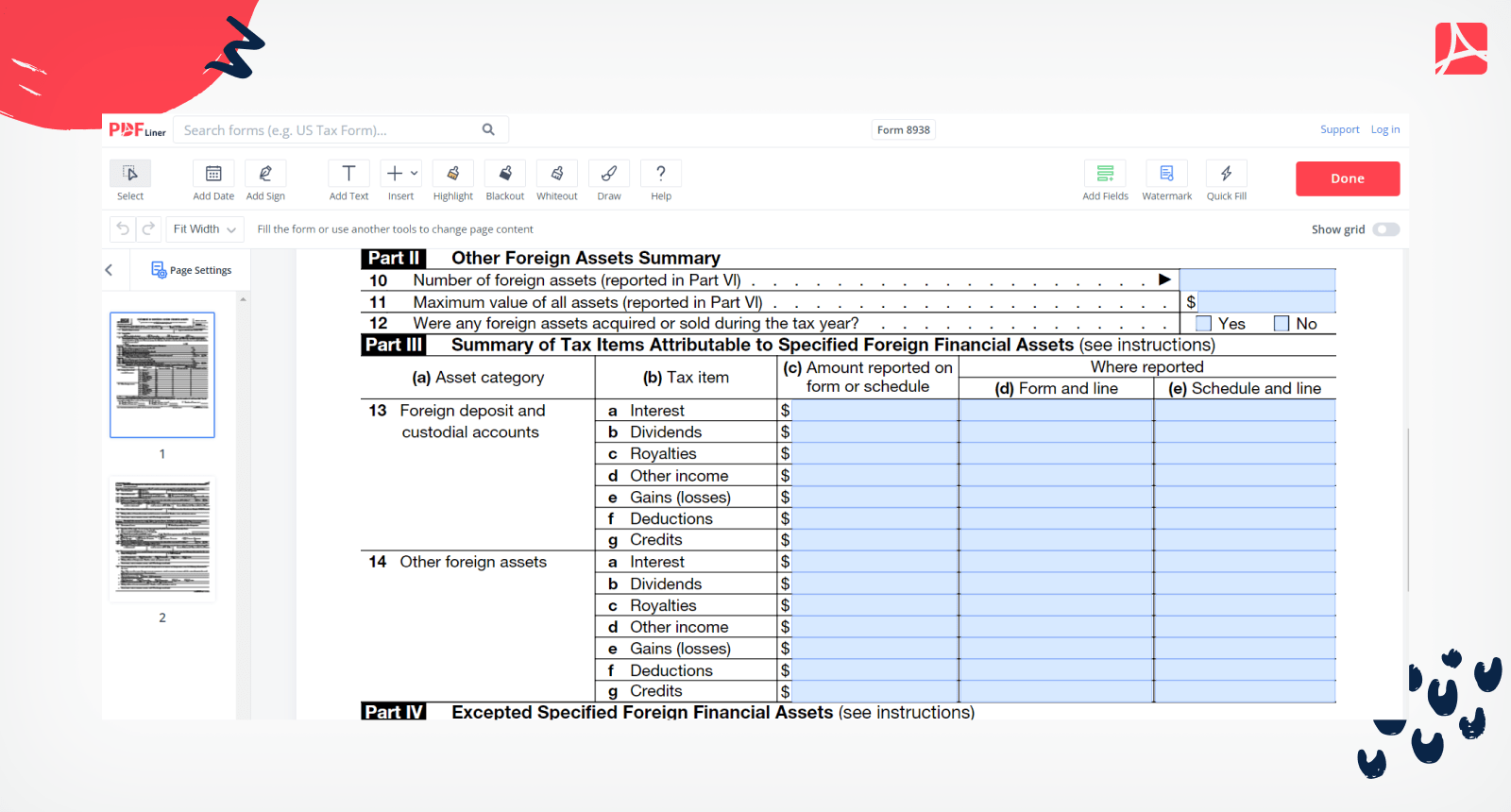

Form 8938 IRS Form 8938 Fillable and Printable blank PDFline

You do not need to. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified.

Form 8938 2023 Printable Forms Free Online

Tax system, especially for taxpayers who have. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Form 8938 is used to report the taxpayer's specified foreign financial assets..

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

Form 8938 is filed if the taxpayer: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Tax system, especially for taxpayers who have. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed..

Form 8938 Edit, Fill, Sign Online Handypdf

Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form.

8938 Form 2021

Form 8938 is filed if the taxpayer: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. You do not need to. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Tax system, especially for taxpayers.

Form 8938 Blank Sample to Fill out Online in PDF

Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do not need to. Tax system, especially for taxpayers who have. Form 8938 is used.

Form 8938 Edit, Fill, Sign Online Handypdf

Form 8938 is used to report the taxpayer's specified foreign financial assets. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Use form 8938 to.

You Do Not Need To.

If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Tax system, especially for taxpayers who have.

Form 8938 Must Be Filed By “Specified Individuals” With “Specified Foreign Financial Assets.” A Specified Individual Is A U.s.

Form 8938 is used to report the taxpayer's specified foreign financial assets. Form 8938 is filed if the taxpayer: Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march.